Guides

Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandateBank Account Data - Sandbox

Account Information Sandbox

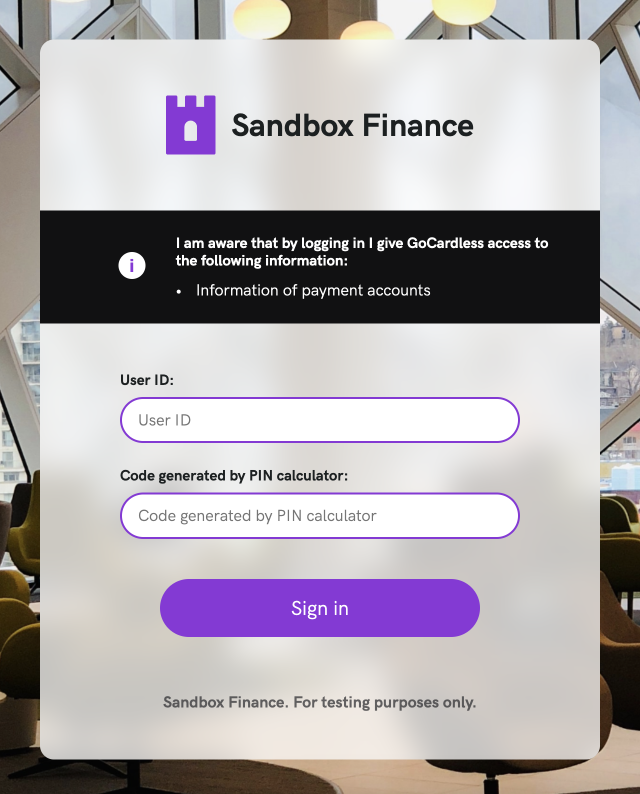

We have created Sandbox Finance which is a mock-up bank you can use to test Account Information product.

We suggest you follow the Quickstart Guide for integration. Below are the guidelines on how to use Sandbox Finance in that process.

Applying in Integration

There are two steps when one has to provide a unique identifier for an financial institution: creating an end user agreement and building a Link.

In those two steps, whenever you need to provide an institution_id, provide SANDBOXFINANCE_SFIN0000 as a value. When the end user accesses the link, it will start a connection with Sandbox Finance.

Using in End User Flow

The end users can provide any input value for user id and code generator fields in the Sandbox Finance authentication page to continue the journey.

When the end user authenticates with Sandbox Finance, you can query results similar to any real connection.