Partners: Onboarding your users

Helping your users get verified

Before your users can actually start collecting payments and getting their payouts, their GoCardless account needs to be verified. This is a must-do for anti-money laundering (AML) rules.

The verification process is pretty straightforward, but it asks your users to:

Provide detailed information about their business.

Upload proof of identity and address.

Add their bank account details and prove ownership of the account.

We collect all these details through our own dedicated, hosted onboarding flow. Once a user signs up to GoCardless via your app, you should immediately check their verification status and send them to this flow if they need to complete it.

Checking a user’s verification status

Once a user completes the OAuth flow and you have an access token, you need to find out if the user needs to go through the verification process. Most new users will, but some might be connecting an existing, verified account.

You can find your user’s verification status in the Creditors API using the verification_status attribute. You can query it like this:

1<?php

2require 'vendor/autoload.php';

3

4$client = new \GoCardlessPro\Client([

5 'access_token' => $currentUser->gocardlessAccessToken,

6 'environment' => \GoCardlessPro\Environment::SANDBOX

7]);

8

9// The Creditors API returns a list of creditors, but any GoCardless account connected

10// to your application will have a single creditor, so you can just look at the first one

11$creditor = $client->creditors()->list()->records[0];

12

13// We'll see below how to redirect users to the onboarding flow, and how it works

14if ($creditor->verification_status == "action_required") {

15 redirectToOnboardingFlow();

16}A creditor’s verification status will be one of these three values:

Creditor Verification Statuses

Status Value | What it Means | What Your App Should Do |

|---|---|---|

| They are all set and fully verified. | Nothing. They can collect payments and receive payouts! |

| They have sent all required information, and GoCardless is reviewing it. | They can't collect or get payouts yet. Do not redirect them. Just show a message letting them know it's being reviewed. |

| We need more information to complete their verification. | You should immediately redirect them to the dedicated onboarding flow. |

Users might revert back to in_review or action_required even after being successful (like if they change their bank account). Always check the status before allowing payment or payout features.

We highly suggest adding clear messages in your UI if they are not successful (telling them why they can't collect/get paid) and pointing them to the onboarding flow if they're in action_required.

Sending your user to the onboarding flow

If the user's status is action_required, you need to send them to the dedicated GoCardless onboarding flow so they can provide the missing details.

Onboarding Flow URLs

Environment | URL |

|---|---|

Sandbox | |

Live |

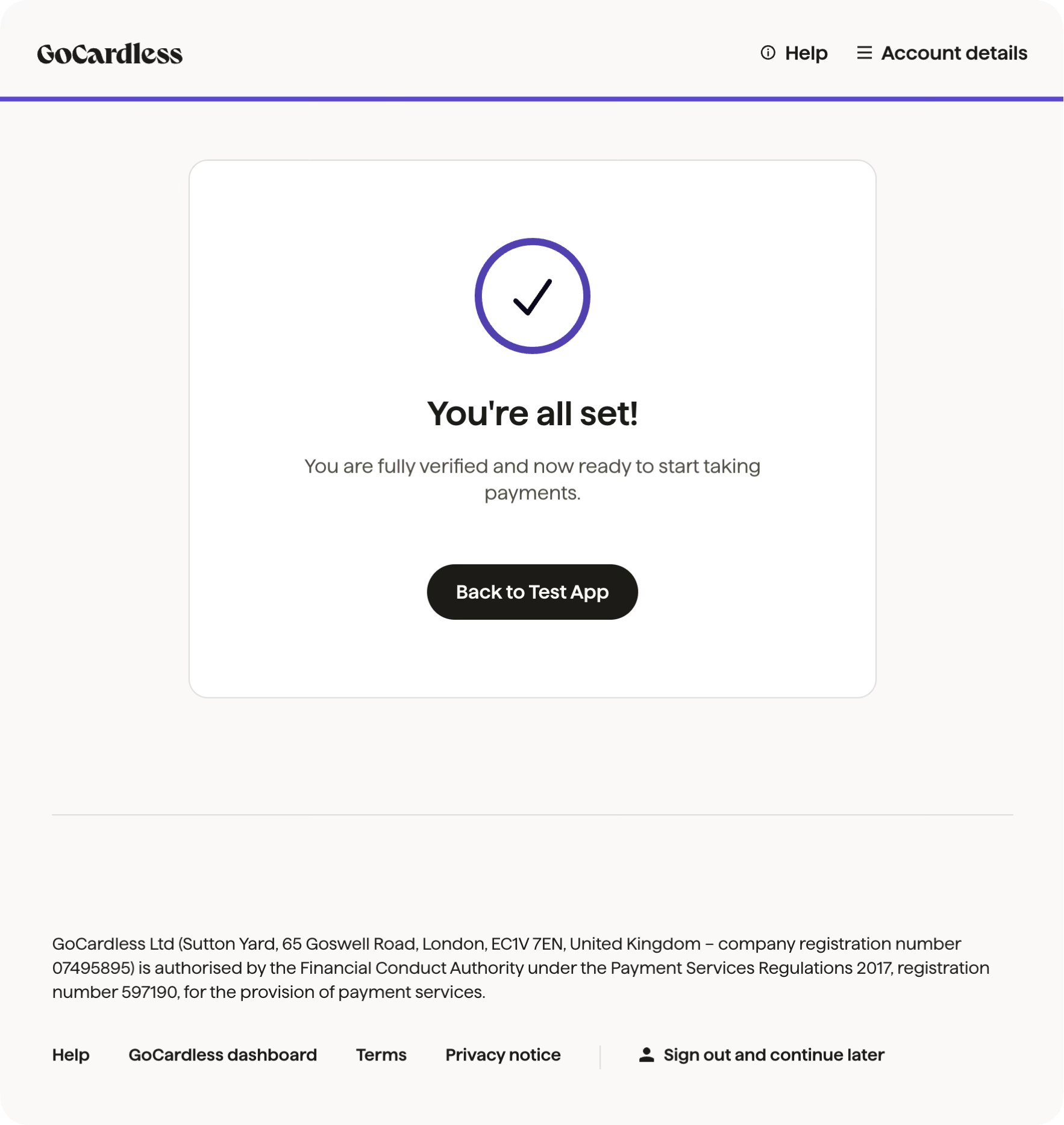

There, the user will fill in all the necessary information about themselves, their business, and their bank details. Once they’re done, they might see an option to head back to your app. This happens only if two things are true:

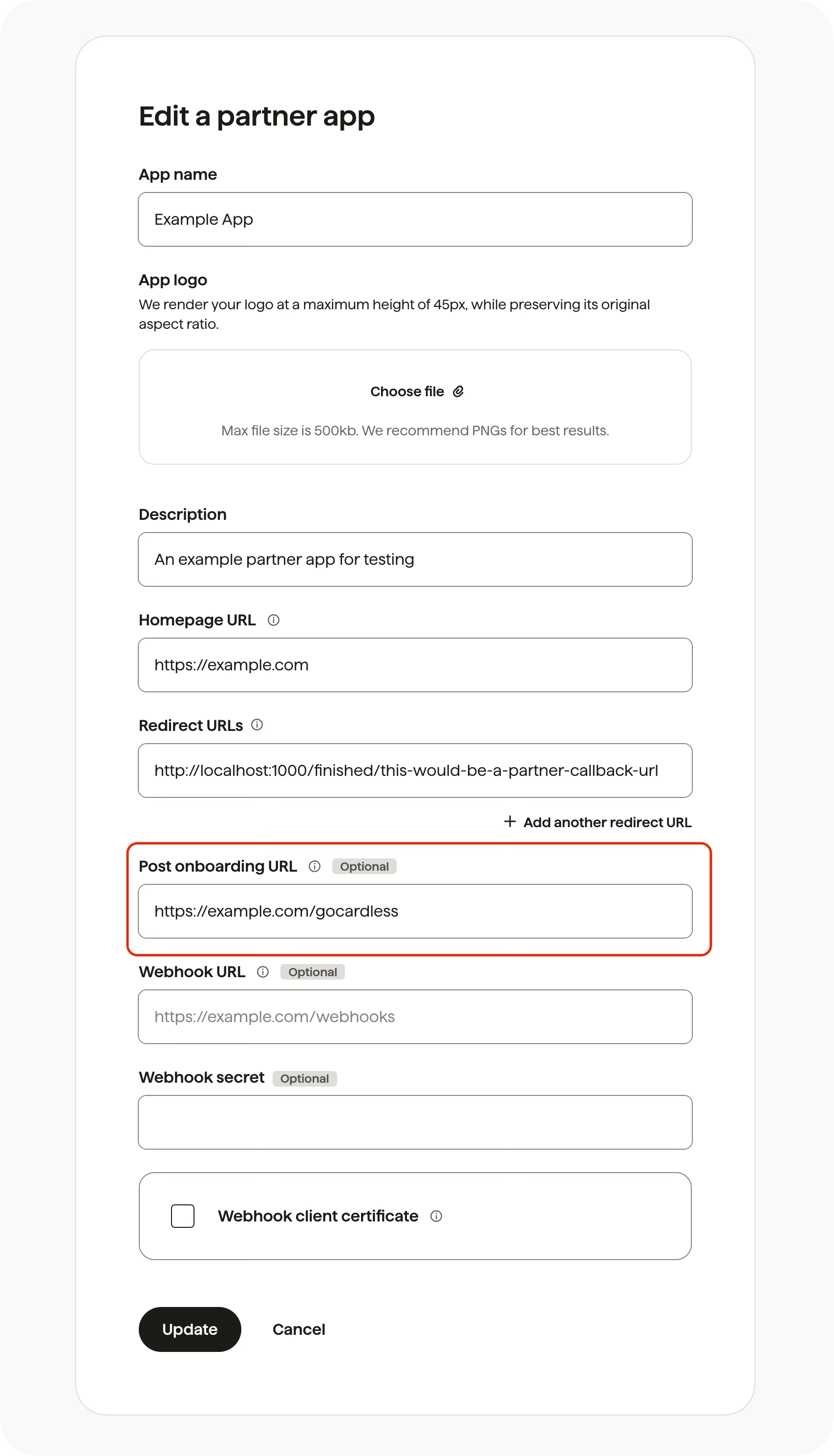

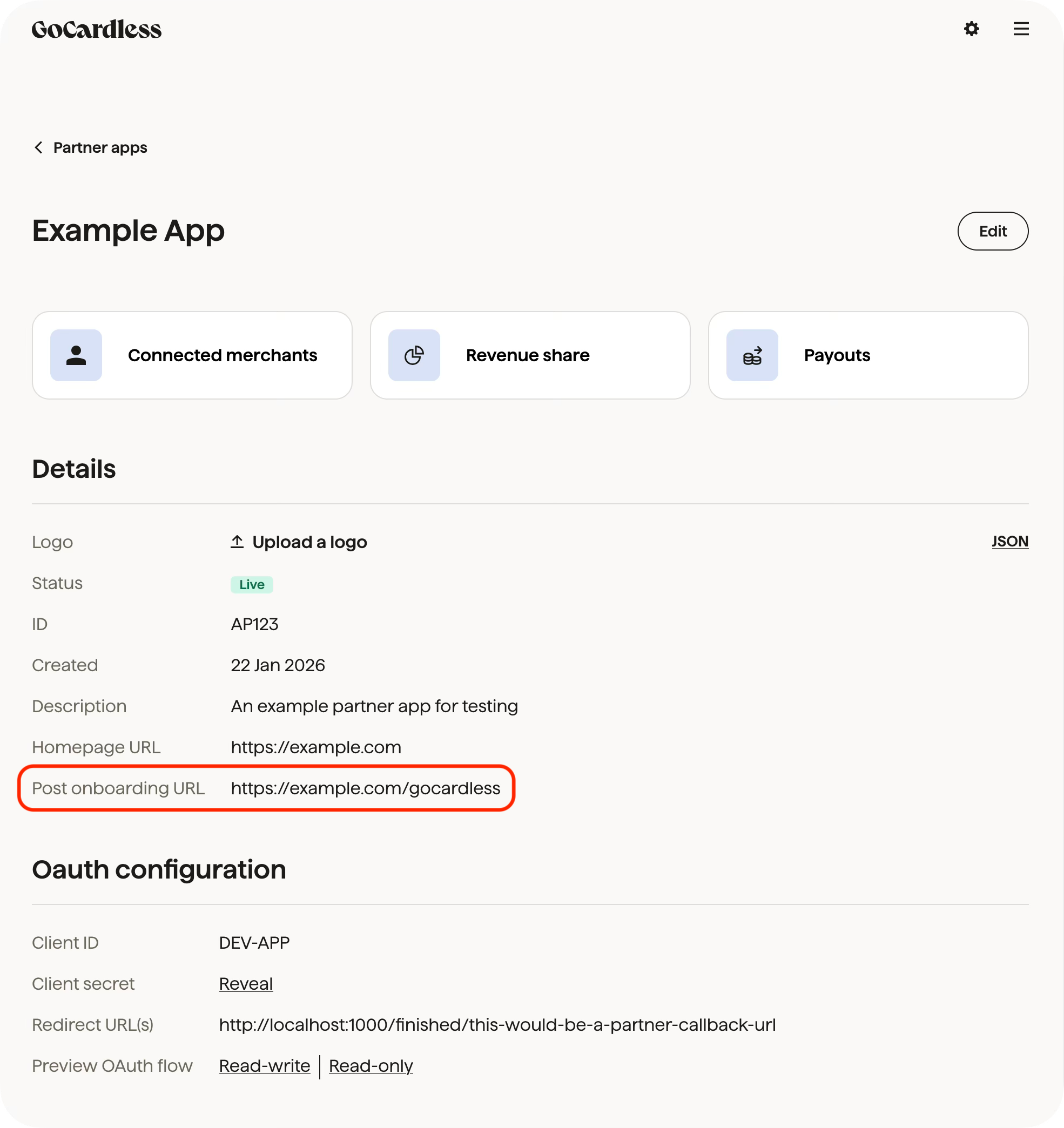

You have set a post onboarding URL in your app settings.

The user is connected to just your app.

You can set the post-onboarding URL in the app creation or editing forms. If you're all set up, you can find the current URL on your app details page.

When they complete the flow, they’ll see a screen that offers a convenient way to return to your app (but note, it’s not an automatic redirect).

When your user lands back in your product, it’s likely that their verification status will not yet be successful. Some of the information provided by users requires review by GoCardless, so it may be a little while before they move to the successful state. Or in some cases, further information will be requested, meaning they’ll move back to action_required.

Once you see that they're in that successful state and you're all done with this part, you're ready to move on to the next step: helping them to start collecting payments and getting paid!

What's Next

Start building your partner integrationLearn how to setup mandates for your merchants