Developer Resources

GoCardless CLI

Installation Testing Webhooks (CLI) About CLI gocardless gocardless analytics gocardless analytics disable gocardless analytics enable gocardless analytics status gocardless cancel gocardless completion gocardless config gocardless config current-session gocardless create gocardless delete gocardless get gocardless get creditor gocardless get customer gocardless get customer_bank_account gocardless get customer_notification gocardless get event gocardless get mandate gocardless get mandate_import gocardless get payer_authorisation gocardless get payment gocardless get payout gocardless get refund gocardless get subscription gocardless get webhook gocardless list gocardless list creditors gocardless list customer_bank_accounts gocardless list customer_notifications gocardless list customers gocardless list events gocardless list mandate_imports gocardless list mandates gocardless list payer_authorisations gocardless list payments gocardless list payouts gocardless list refunds gocardless list subscriptions gocardless list webhooks gocardless listen gocardless login gocardless mcp gocardless mcp add gocardless mcp add claude gocardless mcp add codex gocardless mcp remove gocardless mcp remove claude gocardless mcp remove codex gocardless mcp run gocardless open gocardless trigger gocardless trigger billing_request_fulfilled gocardless trigger billing_request_fulfilled_payment_failed gocardless trigger billing_request_fulfilled_payment_paid_out gocardless trigger billing_request_pending gocardless trigger mandate_activated gocardless trigger mandate_expired gocardless trigger mandate_failed gocardless trigger mandate_pending_submission gocardless trigger mandate_transferred gocardless trigger payment_chargeback_settled gocardless trigger payment_charged_back gocardless trigger payment_confirmed gocardless trigger payment_failed gocardless trigger payment_paid_out gocardless trigger payment_pending_submission gocardless trigger payment_submitted gocardless update gocardless versionTools: Scenario Simulators

Scenario simulators

When you’re building an integration with the API, there are some common paths you should make sure your integration handles successfully, for example, a customer cancelling their mandate or a payment failing due to lack of funds.

In the sandbox environment, we provide scenario simulators that allow you to manually trigger certain cases so you can test how your integration responds. These are available in the Developer section of the dashboard and through the API.

Dashboard-triggered scenarios

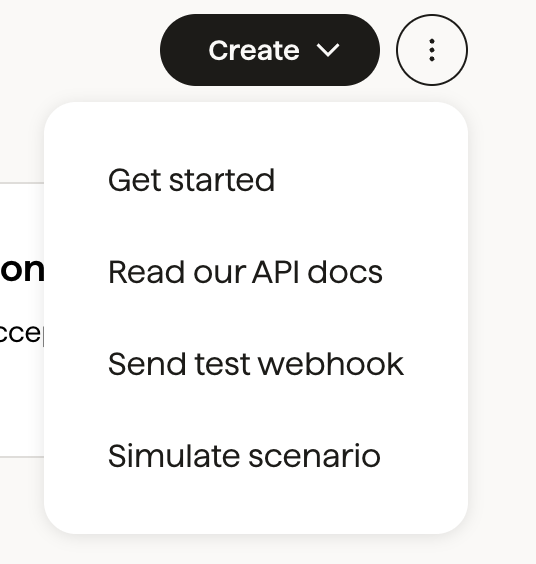

Dashboard-triggered scenarios are started from your Dashboard. Just head to the "Developers" tab, API Settings, on the right-hand side navigate to the Actions dropdown and click "Simulate scenario".

Choose a simulator from the dropdown (for example, "Payment paid out"). Then you'll see more information about that scenario, detailing exactly what will happen and anything you need to know before using it (for example, some scenario simulators are incompatible with every scheme).

Enter the ID of the resource you want to run the simulator on, and then click "Simulate scenario". If there's any problem, for example, we can't find the resource or it isn't compatible with the scenario you've chosen, we'll let you know.

You can use Dashboard-triggered scenarios to try all of the cases supported by the name-triggered scenarios below, plus a few extras (for example, creditor verification status, useful for partners).

API-triggered scenarios

You can trigger simulators via the API. Check out the API documentation for more information.

Name-triggered scenarios

Name-triggered scenarios are scenarios started by using special customer names. For example, if you create a customer with the given_name “Successful”, their mandate will be activated immediately, and their payments will be paid out straight away.

All the relevant events and webhooks will be created and sent for these simulators.

Customer | Description | What happens on mandate creation | What happens on payment creation | Schemes supported |

|---|---|---|---|---|

Successful | The customer’s payment is collected successfully and paid out to you. | The mandate is marked as | The payment is marked as | ACH, Autogiro, Bacs, BECS, BECS NZ, Betalingsservice, PAD and SEPA Core |

Penniless | The customer’s payment can’t be collected, for example, because they don’t have enough money in their account. | The mandate is marked as | The payment is marked as | ACH, Autogiro, Bacs, BECS, BECS NZ, Betalingsservice, PAD and SEPA Core |

Fickle | The customer’s payment is collected successfully, but is then charged back by the customer disputing it with their bank. | The mandate is marked as | The payment is marked as | ACH, Autogiro, Bacs, BECS, BECS NZ, Betalingsservice, PAD and SEPA Core |

Late | The customer’s payment can’t be collected, but the bank informs us of the failure later than normal. | The mandate is marked as | The payment is marked as | ACH, Bacs, BECS, BECS NZ, and SEPA Core |

Invalid | The customer’s mandate can’t be set up because their bank details are rejected by the banks as invalid. | The mandate is marked as | N/A | ACH, Autogiro, Bacs, BECS, BECS NZ, Betalingsservice, and PAD |

Expired | The customer's Bacs or SEPA mandate has expired because no collection attempts were made against it for longer than the scheme's dormancy period (13 months for Bacs, 15 months for BECS and Betalingsservice, 3 years for SEPA). | The mandate is marked as | N/A | ACH, Bacs, BECS, BECS NZ, Betalingsservice, PAD and SEPA Core |

Switching | The customer has an existing Bacs mandate which is transferred to another bank account using the UK’s Current Account Switching Service. | The mandate is marked as | N/A | Bacs only |

Instalment Schedules

The states of instalment schedules are simulated using either a special customer given_name, or a special name for the instalment schedule. Refer to the table below for more information about how you can simulate completed, errored, and creation_failed states:

Instalment Schedule | Customer | Description | What happens on instalment schedule creation |

|---|---|---|---|

N/A | Successful | All payments belonging to the instalment schedule are successfully collected. | The instalment schedule is marked as |

N/A | Penniless | Payments belonging to the instalment schedule cannot be collected. | The instalment schedule is marked as |

Faily | N/A | Instalment schedule will fail with payment creation error message: must be on or after mandate's next_possible_customer_charge_date. | The instalment schedule is marked as |

Outbound Payments

Outbound payment states can be simulated by using a specific value in the description field. Refer to the table below for detailed information on how to simulate payments in executed and failed due to different reasons states:

Outbound Payment | Description | What happens on outbound payment creation |

|---|---|---|

| The outbound payment submission attempt to the bank is unsuccessful. | An outbound payment is first marked as |

| Although outbound payment submission to the bank is successful, it is then rejected by the recipient's bank. | An outbound payment is first marked as |

| Exceptional case: the outbound payment is submitted and accepted, but later rejected by the recipient's bank. | An outbound payment is first marked as |

Any other description | The outbound payment submission to the bank is successful, and it is accepted by the recipient's bank. The outbound payment is on the way to the recipient! | An outbound payment is first marked as |

Payer Name Verification

A No Match Payer Name Verification scenario can be simulated following the Billing Request Flow on Sandbox. At the collect_bank_account_details step if the following details are used, the Account holder name does not match bank account details provided error will appear on the screen.

Account Holder Name

| Sort Code

| Account Number

|

No Match | 200000 | 55779911 |

Confirmation of Payee (CoP) for Outbound Payments

CoP checks are regulatory requirement for outbound payments. They are performed against recipient bank account records to help reduce misdirected payments. A CoP check can return one of the following results: full_match, partial_match, no_match, unable_to_match. You can simulate these results by creating and providing bank accounts with specific account holder names.

Bank Account

|

|

| Description |

|---|---|---|---|

| 200000 | 55779911 | The account name is similar but does not match to the details provided.

The CoP check returns |

| 200000 | 55779911 | The provided name does not match the account details. The CoP check returns |

| 200000 | 55779911 | The verification could not be performed due to recipient bank issues or technical issues. The CoP check returns |

Any other account holder name | 200000 | 55779911 | The account name exactly matches the details provided. The CoP check returns |

Other tools

GC CLIBuild, test and manage your integration with GC directly from your terminal.