Overview

This is the documentation for the GoCardless API.

If you’re just exploring or want to start building an integration, check out our getting started guide for a step-by-step introduction with PHP, .NET, Java, Ruby and Python code samples

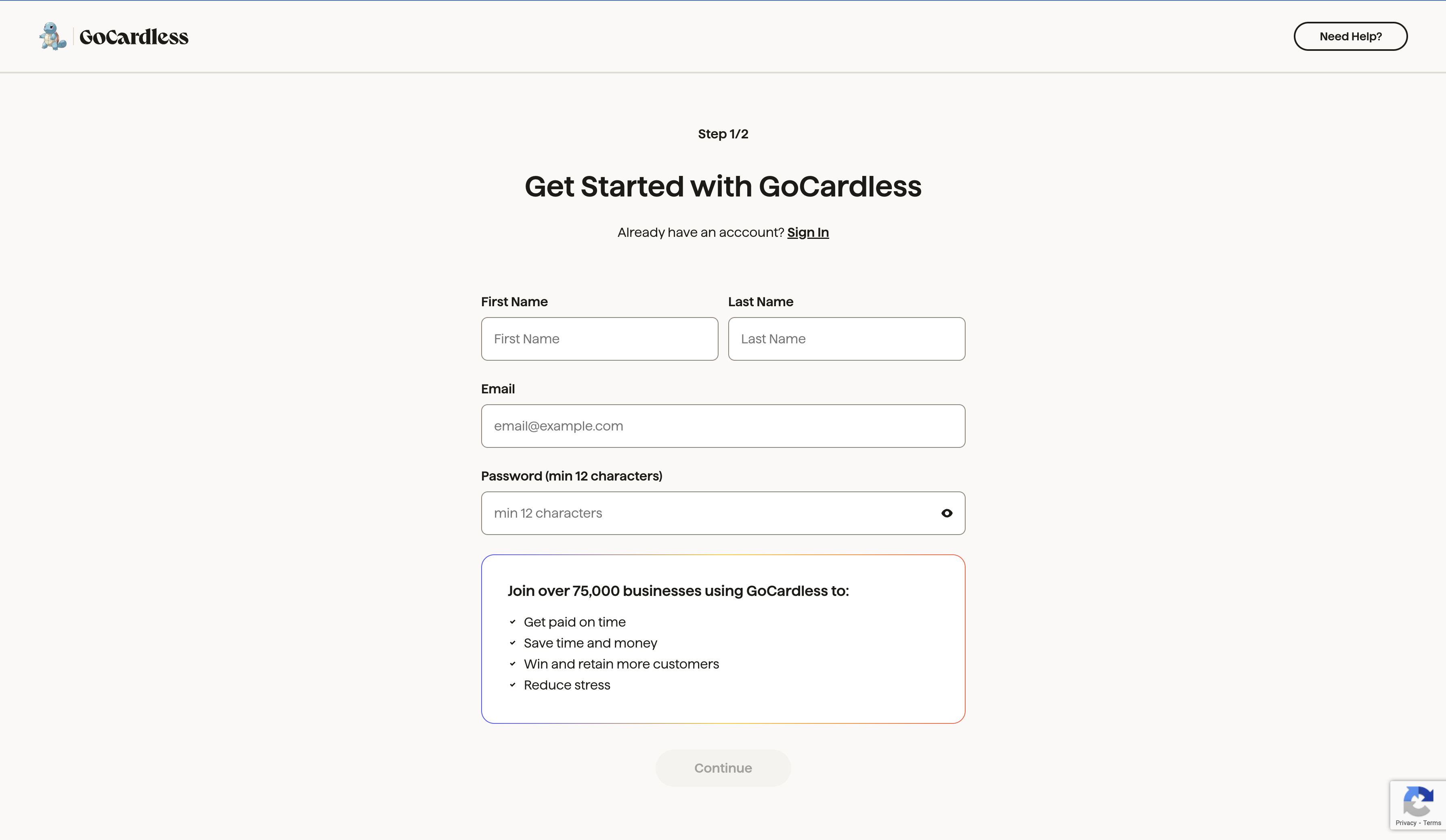

For testing purposes we recommend you sign up for a sandbox account.

Supported Direct Debit Schemes

The GoCardless API currently supports the following Direct Debit schemes:

| Scheme | Countries |

|---|---|

| Bacs | UK & Channel Islands (inc. Jersey & Guernsey) + Isle of Man + Gibraltar (The customer needs to select UK as the country) |

| SEPA Core* | Åland Islands Austria Belgium Cyprus Estonia Finland France French Guiana Germany Greece Guadeloupe Ireland Italy Latvia Lithuania Luxembourg Malta Martinique Mayotte Monaco Netherlands Portugal Réunion San Marino Slovakia Slovenia Spain Saint Barthélemy Saint Martin Saint Pierre and Miquelon |

| ACH | United States |

| Autogiro | Sweden |

| Betalingsservice | Denmark |

| BECS | Australia |

| BECS NZ | New Zealand |

| PAD | Canada |

| PayTo** | Australia |

| Faster Payments*** | UK & Channel Islands (inc. Jersey & Guernsey) + Isle of Man + Gibraltar (The customer needs to select UK as the country) |

Note: There are practical issues with SEPA Direct Debit in some countries that mean we would not recommend using it to collect payments from end customers in those markets. Local implementation can cause problems in the Baltic states in particular - please contact us for more information.

* Collection from all non-Eurozone SEPA countries is also supported through the API, but since only a small percentage of bank accounts in these countries are reachable they have not been listed above.

** PayTo although not technically a Direct Debit scheme can be used as an alternative to BECS.

*** Faster Payments is not a Direct Debit scheme, but an alternative to BACS that can be used for instant and variable recurring payments.

Getting Started

There are three key parts to an integration with the API - you can do one, two or all three of them:

- Setting up mandates with your customers’ bank accounts

- Collecting payments against your mandates

- Staying up-to-date with webhooks

To get started with the API, check out our “getting started” guide, with copy and paste code samples in PHP, Ruby and Python guiding you through your integration from start to finish.

Restrictions

Whilst the entire GoCardless API is accessible in the sandbox environment, the following restrictions exist in live.

Payment page restrictions

Unless your payment pages have been approved as scheme rules compliant by our sponsor bank you must use the Billing Requests API to create customers, bank accounts and mandates.

The following endpoints are therefore restricted:

- Billing Requests: Create_customer_details, Collect_bank_account

- Customers: Create

- Customer bank accounts: Create

- Mandate: Create, Reinstate

- Javascript flow: All endpoints

Please get in touch to discuss having your payment pages approved.

Creditor management restrictions

Unless your account has previously been approved as a whitelabel partner you may only collect payments on behalf of a single creditor. The following endpoints are therefore restricted:

- Creditors: Create

Anatomy

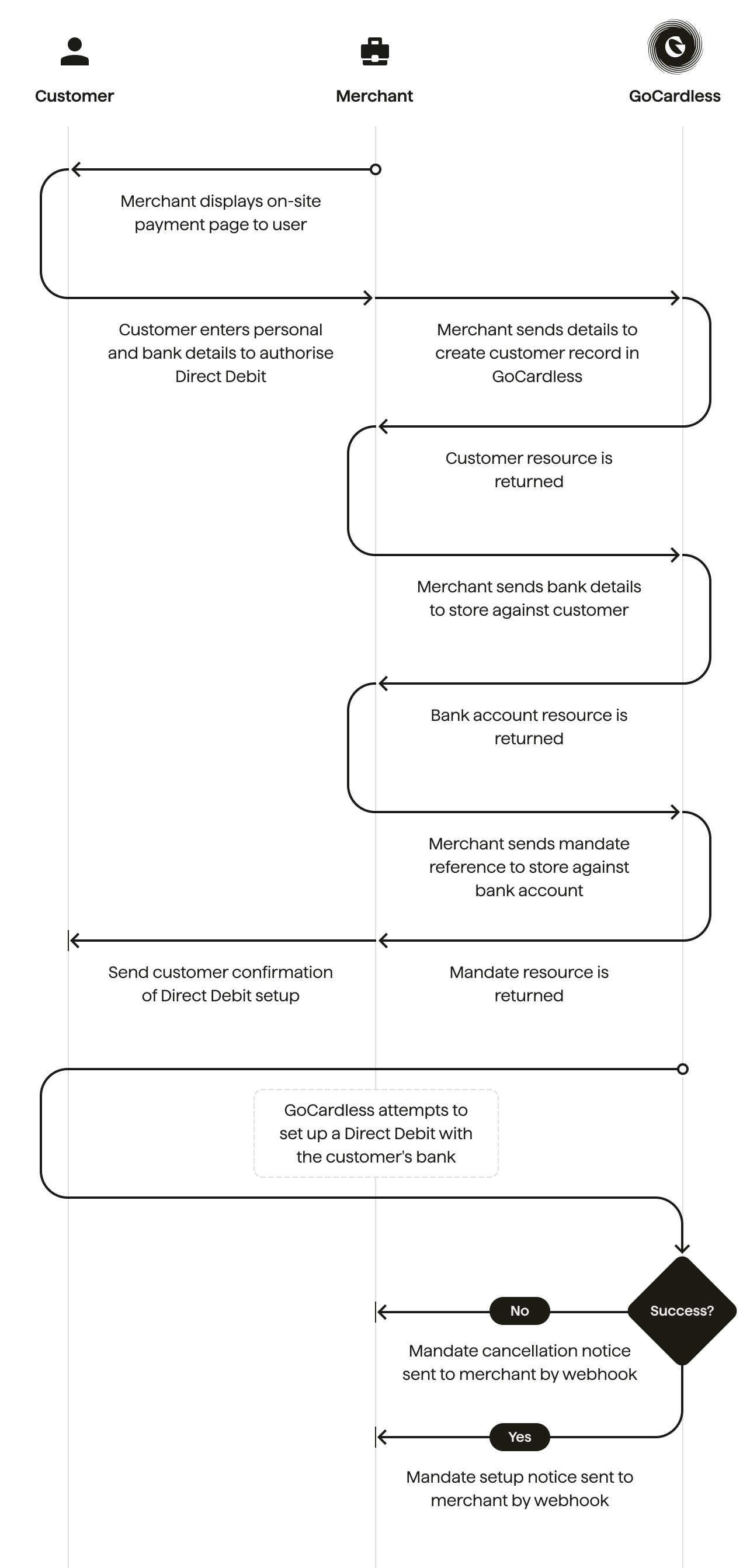

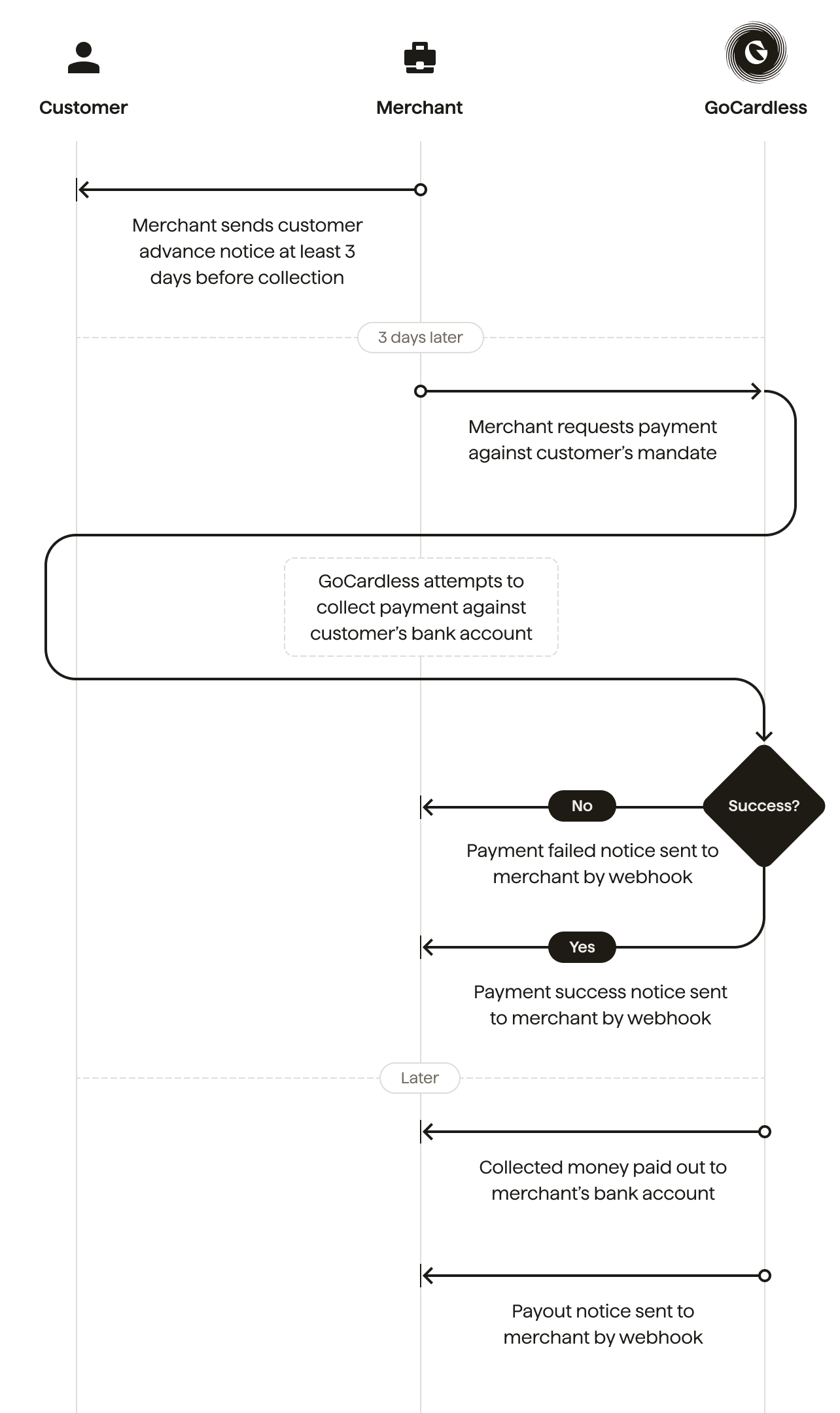

The following state diagrams explain the flows of mandate setup to setup customers on a Direct Debit and payment creation, to collect payment against said mandate. There’s also a short section on how timings work.

Mandate setup

Payment creation

How timings work

Direct debit payments don’t process instantly, and work differently to card payments.

For the UK:

- If a Direct Debit mandate is already in place, payment is collected 2 working days after submission, can be considered 95% confirmed 3 working days after submission, and 100% confirmed after 4 working days.

- If a Direct Debit mandate needs to be created, payment is collected 4 working days after submission, can be considered 95% confirmed 5 working days after submission, and 100% confirmed after 6 working days.

There’s also a requirement to notify your customers 3 working days before payment leaves their account. See the notifications section for more detail.

For more information on UK timings, see our detailed guide.

For ACH:

- New mandates take up to 2 interbank business days before payments can be submitted under them.

- For all payment collections, you must submit the collection to the banks 2 interbank business days before the payment due date.

You will need to notify your customers at least 2 working days in advance of the payment being collected.

For more information on ACH timings, see our detailed guide.

For Autogiro:

- New mandates take up to 6 interbank business days before payments can be submitted under them.

- For all payment collections, you must submit the collection to the banks 2 interbank business days before the payment due date.

You will need to notify your customers at least 8 working days in advance of the payment being collected.

For more information on Autogiro timings, see our detailed guide.

For BECS:

- For all payment collections, you must submit the collection to the banks 1 interbank business day before the payment due date.

For more information on BECS timings, see our detailed guide.

For BECS NZ:

- For all payment collections, you must submit the collection to the banks 2 interbank business days before the payment due date.

For more information on BECS NZ timings, see our detailed guide.

For Betalingsservice:

- New mandates must be created at least one working day before payments can be created.

- For all payment collections, you must submit the collection 8 working days before the end of the month preceding the month in which you wish to take the payment

For more information on Betalingsservice timings, see our detailed guide.

For PAD:

- For all payment collections, you must submit the collection to the banks 3 interbank business days before the payment due date.

For more information on PAD timings, see our detailed guide.

For PayTo:

- There is no advance notice period and payments can be taken almost instantaneously.

For Faster Payments:

- There is no advance notice period and payments can be taken almost instantaneously.

For SEPA Core:

- For all payment collections, you must submit the collection to the banks 3 interbank business days before the payment due date.

You will need to notify your customers 3 working days in advance of the payment being collected.

For more information on SEPA timings, see our detailed guide.

In all cases, you can still test these as if they were instant - for more detail, see the section on testing your integration.

Backwards Compatibility

The following changes are considered backwards compatible:

- Adding new API endpoints

- Adding new properties to the responses from existing API endpoints

- Reordering properties returned from existing API endpoints

- Adding optional request parameters to existing API endpoints

- Altering the format or length of IDs

- These strings will never exceed 255 characters, but you should be able to handle anything up to that length

- Altering the

messageattributes returned by validation failures / other errors - The number of and duration between retries for failed webhooks

- The behaviour of Scenario Simulators

- Sending webhooks for new event types

Changelog

- 8th January 2024

- Added API fields for Faster ACH:

- 18th July 2023

- Updated our public certificate policy.

- 21 June 2023

- Added the

resource_metadataproperty to Events. - 16 March 2023

- Added

show_success_redirect_buttonparameter to Billing Request Flow creation. - 1st March 2023

- Changed the Payout Items API to only return Payout Items created in the previous 6 months.

- 22nd February 2023

- Made the Billing Requests API and the Blocks API respond in English if the

Accept-Languageheader isn’t set, like other API endpoints. These two APIs used to infer the language from the IP address of the client, which wasn’t the intended behaviour. - 8th February 2023

- Added

billing_request[purpose_code]parameter to Billing Request creation. - 13th January 2023

- Added the

verified_attimestamp field to the mandates API. - 23rd December 2022

- Updated our public certificate policy.

- 20th December 2022

- Added

authorisation_sourceparameter to the Mandate creation API andmandate_request[authourisation_source]parameter to the BillingRequest creation API. This field is required for offline mandates. - 13th December 2022

- Added

creditor_typeparameter to the Creditors API. This field represents the type of business of the creditor. It will now be required when creating a creditor and it will be returned when fetching creditors. - 9th December 2022

- Added

languageparameter to Billing Request Flow creation. - 11th November 2022

- Added

mandate_request[description]andmandate_request[constraints]parameter to Billing Request creation. Constraints restricts the kind of payment that can be taken against a mandate. - 1st November 2022

-

Payout Items are no longer ordered by

type. The order of Payout Items for a given Payout is still consistent between requests. - 5th August 2022

- Added

payer_requested_dual_signatureparameter to Billing Request action confirm payer details. - 21st July 2022

- Added

prefilled_customerandprefilled_bank_accountparameters to Billing Request creation. - 14th July 2022

- Added

mandate_request[reference]parameter to Billing Request creation. - 10th May 2022

- Autogiro scheme is now available in Billing Request flow. Documentaion can be found here

- 4th May 2022

- Event creation is now an asynchronous process. This means it can take some time between an action occurring and its corresponding event being made available in API responses.

- 26th January 2022

- Added support for filtering events by instalment schedule in the events List API.

- 31st December 2021

- Added support for Sepa Credit Transfer and Sepa Instant Credit Transfer, the Instant Bank Pay schemes inside Billing Request.

- 18th November 2021

- Added block endpoints. These endpoints allow to create a block based on payers bank_account, email and email_domain, view the blocked items.

- 5th August 2021

- Fixed reason codes sent for BECS so that they are consistent with the documentation.

Eg.

direct_debit_not_enabledevents will be sent with Reason code2instead ofRETURNS-2, as per documentation. - 30th March 2021

- Added Scenario Simulators endpoint. These allow manual testing of certain flows in the Sandbox environment

- 26th March 2021

- Added a new resource called Billing Requests. This is our new API dedicated to building custom payment pages. It encapsulates the creation of customer, bank account and mandate under this single resource.

- 28th January 2021

- Added webhook endpoints. These allow you to view

and retry webhooks that we have sent to you. As part of this we began

including

webhook_idinside themetakey in the webhooks we send. - 30th October 2020

- Added a new resource called payer_authorisatons. This is our new API dedicated to building custom payment pages. It encapsulates the creation of customer, bank account and mandate under this single resource.

- 12th August 2020

- Added a new event called

payer_authorisation_completedfor an upcoming resource type calledpayer_authorisation. - 14th July 2020

- Added support for applying tax to transaction and surcharge fees.

- Added

taxesto payout_items. - Added

tax_currencyto payout. - Added tax_rates endpoint.

- Added a payout

tax_exchange_rates_confirmedwebhook to know when the exchange rate has been finalised for all fees in the payout.

- Added

- 9th July 2020

- Allow changing

retry_if_possiblewhen updating a subscription. - 27th May 2020

- Added a

not_retried_reasonfield to the event details for failed payment event. - 7th May 2020

- Updated the type of

bank_account_typefromstringtoenum.bank_account_typeis referenced increditor_bank_accounts,customer_bank_acount_tokens,customer_bank_accountsandmandate_pdfsendpoint. - 20th April 2020

- Added

prefilled_bank_accountattribute in the redirect flow create endpoint to allow the integrator to prefill theaccount_typefield. - 20th April 2020

- Added metadata to payouts, and added new update payouts route so that integrators can use it.

- 6th April 2020

- We are updating the wording of the documentation for

prefilled_customer[region]attribute in redirect flow create endpoint. - 26th March 2020

- We have added the ability to capture metadata attribute as part of redirect flow create endpoint.

- 17th March 2020

- We’ve added the ability to pause and resume subscriptions.

- 19th February 2020

- We’ve optimised our webhook batching to become slightly more effective. This means each webhook will have on–average–slightly more events per request than we have sent previously.

- 18th Februrary 2020

- Added new events for creditors:

updatednew_payout_currency_added

- 6th February 2020

- Added support for Success+ intelligent retries

- Added a new

retry_if_possiblefield to the Payments, Subscriptions & Instalment Schedules endpoints - Added a

will_attempt_retryfield to the event details for failed payment event.

- Added a new

- 6th February 2020

- Added new disconnected webhook for partners

- 29th January 2020

- Added 3 fields to the Creditors endpoint:

mandate_imports_enabled,merchant_responsible_for_notificationsandcustom_payment_pages_enabled. - 28th January 2020

- Added support for instalment schedules.

- Added documentation for new Instalment Schedules endpoint.

- 27th January 2020

- Marked the

phone_numberfield in Customers as optional. - 19th November 2019

- Added support for international payments.

- Added

fxto Payments, Payouts & Refunds - Added support for surcharge fees.

- Added new

surcharge_feetype for Payout Items. - Added payment webhooks for surcharge fee events (

surcharge_fee_creditedandsurcharge_fee_debited)

- Added

- 23rd July 2019

- Added new customer removal API.

- 21st February 2019

- Added new

payment_autoretriedevent cause for thepayment_resubmission_requestedaction. - 19th December 2018

- Added the ability to handle

subscription_createdemails. - 5th December 2018

- Added support for PAD, the Direct Debit scheme in Canada, in beta.

- 16th October 2018

- Added new event for refund

failed(refund_failed). - 11th September 2018

- Added support for BECS NZ, the Direct Debit scheme in New Zealand, in beta.

- 30th August 2018

- Add

links[default_aud_payout_account]as an updatable field to the creditors API - 22nd August 2018

- Removed

can_create_refundsas an updatable field from the creditors API - 17th August 2018

- Added the ability to handle

payment_createdandmandate_createdemails. - 12th July 2018

- Added customer address fields to the mandate PDFs API.

- 27th June 2018

- Added support for Betalingsservice, the Direct Debit scheme in Denmark, in beta.

- 22nd May 2018

- Added

app_feefield to responses from the subscriptions API. - 17th May 2018

- Took the payout items API out of beta.

- Improved the documentation of the mandate PDFs API, clarifying what languages are supported for each scheme and documenting that the default language is English.

- 15th May 2018

- Added the maximum payment and refund

referencelengths for Becs. - 26th April 2018

- Added the mandate imports API, allowing partners to more easily migrate mandates to GoCardless.

- 20th April 2018

- Added information on our public certificate policy.

- 11th April 2018

- Added support for BECS, the Direct Debit scheme in Australia, in beta.

- 6th March 2018

- Added contact email address to responses from the OAuth introspect API and access token API.

- 13th February 2018

- Added support for multiple redirect URIs per partner app.

- 26th January 2018

- Added the new OAuth introspect API, allowing partners to check if access tokens are valid and find out more about them

- Added the new OAuth revoke API, allowing partners to disconnect users from their app, invaliding their access token

- 15th January 2018

- Added additional characters to the list of allowed characters for SEPA mandate and payment references

- 1st December 2017

- Added read-only

can_create_refundsfield to responses from the creditors API. - 30th November 2017

- Renamed

exceeded_max_amendmentserror on subscriptions tonumber_of_subscription_amendments_exceededwhen updating a subscription. - 16th November 2017

- Added filtering by

referenceto the payouts API. - 14th November 2017

- Added filtering by

statusto the subscriptions API. - 13th November 2017

- Added the new payout items API, allowing you to view, on a per-payout basis, the credit and debit items that make up that payout’s amount.

- 25th October 2017

- Allow changing

amountwhen updating a subscription. - 23rd October 2017

- Added new event for subscription

amendedaction. - 18th September 2017

- Added

confirmation_urlto the redirect flows API. - 19th June 2017

- Added the

Originheader to webhooks, specifying the GoCardless environment that a webhook was sent from (https://api.gocardless.comfor live,https://api-sandbox.gocardless.comfor sandbox). - 19th May 2017

- Added

verification_statusto the creditors API. - 11th May 2017

- Deprecated

end_datein the subscriptions API. - 17th March 2017

- Added new

mandate_expiredcause for the paymentcancelledaction(#payment-cancelled). - 13th March 2017

- Added

app_feeto the subscriptions API. - 2nd March 2017

- Added

prefilled_customerto the redirect flows API. - 20th February 2017

- Added

scheme_identifiersto the creditors API. - 2nd February 2017

- Added new event for mandate

replacedaction. - 2nd August 2016

- Added

deducted_feesto the payouts API. - 7th July 2016

- Added

payments_require_approvalto the mandates API. - 11th February 2016

- Added

arrival_dateto the payouts API. - 21st January 2016

- Restricted specifying payment references on Bacs payments to only those organisations using their own Service User Number.

- 6th January 2016

- Added filtering by

created_atto the customer bank accounts API. - 20th October 2015

- Added filtering by

created_atto the mandates API. - 16th October 2015

- Added filtering by

created_atto the payouts API. - 30th September 2015

- Added support for app fees to the OAuth API, in beta.

- 29th September 2015

- Added support for Autogiro, the Direct Debit scheme in Sweden, in beta.

- 16th September 2015

- Added

request_pointerfield to validation errors, in the form of JSON pointer. See validation errors for more details. - 10th September 2015

- Added

referenceto the refund API. This sets a reference which will appear with the refund on the customer’s bank statement. - 17th August 2015

- Added

languageto the customer API. This sets the language of notification emails sent by GoCardless to the customer. Defaults to the native language of the customer’s country. - 2nd August 2015

- Added support for SEPA COR1, a faster version of SEPA Direct Debit

available in Spain, Germany and Austria. COR1 will be used

automatically if possible when creating new SEPA mandates, unless

you specify the

schemeattribute explicitly. The returnedschemeattribute will besepa_cor1. - 29th July 2015

- Added

customer_bank_accountandcustomerto the complete redirect flow endpoint returned properties. - 23rd July 2015

- Removed support for API version

2014-11-03. - 22nd July 2015

- Added

bicto the bank details lookups endpoint returned properties. - 6th July 2015

- Released API version

2015-07-06. See blog post for more details and upgrade guide.- Removes

Helpersendpoint from the API - Renames

start_atandend_aton subscriptions tostart_dateandend_date - Enforces date format (not datetime) for payment

charge_date

- Removes

- 2nd July 2015

- Renamed the beta modulus checks endpoint to bank details lookups and took it out of beta.

- 30th June 2015

- Added mandate PDFs endpoint, which will replace the previous mandate helper endpoint and the ability to request a PDF from the “get a single mandate” endpoint in a future version.

- 26th June 2015

- Added top level modulus checks endpoint, which will replace the previous modulus check helper endpoint in a future version.

- 15th June 2015

- Updated MIME type negotiation to 406 if a bad

Acceptheader is provided. - 9th June 2015

- Added new events for payment created, subscription created, and refund paid.

- 29th April 2015

- Released API version

2015-04-29. See blog post for more details and upgrade guide.- Removes

RolesandUsersfrom the API - Replaces

Api KeyswithAccess Tokens - Replaces

Publishable Api KeyswithPublishable Access Tokens - Removes explicit sort_code field from bank account creation APIs in favour of local details

- Removes

Webhook-Key-Idheader from webhooks we send

- Removes

Client Libraries

We also provide client libraries to make your integration easier.

Currently we have the following libraries available:

- GoCardless Pro Ruby

- GoCardless Pro Python

- GoCardless Pro Java

- GoCardless Pro PHP

- GoCardless .NET

- GoCardless Node.js

- GoCardless Pro Go

- GoCardless Pro Android

- GoCardless Pro iOS

If there’s a another language you’d like a library for, please get in touch to let us know.

Making Requests

Base URLs

The base URLs for the GoCardless API are

- https://api.gocardless.com/ for live

- https://api-sandbox.gocardless.com/ for sandbox

The API is only available over HTTPS. Attempting to access the API over an

unsecured HTTP connection will return a tls_required error.

Authentication

After creating an access token in the dashboard, you must provide it in an Authorization request header (using the bearer authentication scheme) when making API requests.

Authorization: Bearer TOP_SECRET_ACCESS_TOKEN

If you’re using our JavaScript Flow, you must use a publishable access token instead.

Versions

Every request must specify a GoCardless-Version header, with a released

API version.

GoCardless-Version: 2015-07-06

Currently available versions:

2015-07-06- Removed helper endpoint (replaced with new individual endpoints).

Historic versions which are no longer available:

2015-04-29- Changed auth and removed sort_code.

2014-11-03- Changed validations on charge_customer_at.

2014-10-03- Enforced validation of keys passed to all endpoints.

2014-09-01- First Pro API release.

MIME Types

All requests and responses are JSON-formatted and UTF-8 encoded.

An Accept header is required for all requests, for example:

Accept: application/json

A Content-Type and Content-Length header must be given when sending data to the API

(using POST and PUT endpoints), for example:

Content-Type: application/json

Content-Length: 3495

For the Accept and Content-Type headers, you may

give either the standard JSON MIME type (application/json), or the JSON-API

variant (application/vnd.api+json).

You will receive an invalid_content_type error if you attempt to make a POST/PUT

request without one of these MIME types.

In the case of a missing Content-Length header,

you will receive an Error 411 (Length Required) error message. Although, the majority

of HTTP clients should send the header by default.

PUT, PATCH and DELETE

If your HTTP client or proxy doesn’t support PUT or DELETE, you

can instead make a POST request with the header X-HTTP-Method-Override: PUT

or X-HTTP-Method-Override: DELETE.

The HTTP PATCH verb is not allowed by the API, and will result in a

method_not_allowed error. Please use PUT to alter an existing resource.

Rate Limiting

We apply a rate limit to all API requests, to prevent excessive numbers of simultaneous requests from an individual integrator degrading the API experience for others.

Currently, this limit stands at 1000 requests per minute. If you are making requests from

a partner integration (on behalf of a merchant), the rate limit is 1000 requests per

minute per merchant. The limit can always be found in the response header

ratelimit-limit.

If your API call returns a 429 status code with a rate_limit_exceeded error, you have

exceeded this limit. These requests can be safely retried. We supply information in the

ratelimit-remaining and ratelimit-reset headers, which indicate how many requests are

allowed in the current time window, and the time after which the rate limit will reset,

respectively.

For example, reading response headers like these, your integration is permitted to make a

further 163 requests until Thu, 03 May 2018 16:00:00 GMT, after which the limit will

reset back to 1000 for the next time window:

ratelimit-limit: 1000

ratelimit-remaining: 163

ratelimit-reset: Thu, 03 May 2018 16:00:00 GMT

If you are planning to make a large number of requests to our API, our rate limit should be regarded as a performance target: if you can successfully hit 1000 requests/minute, your task will be completed in the shortest possible time.

Timeouts

Some timeouts affect HTTP requests and connections to the API.

- Request Timeout - we have a request timeout of 29 seconds. A single request cannot last more than this amount of time.

- Keepalive Timeout - we have a keepalive timeout (also known as an idle timeout) of 10 minutes on persistent HTTP connections. If a connection has been open with no request for that time period, the connection will be closed.

Idempotency Keys

Some requests are dangerous to make twice. In a situation like submitting payments, retrying a request that appeared to fail (for example due to a network timeout) could lead to a payment being taken twice. This is clearly undesirable.

When creating resources, our API supports idempotent creation. If you make a request

with an Idempotency-Key header, we only allow that key to be used for a single

successful request. Any requests to create a resource with a key that has previously been

used will not succeed, and will respond with a 409 idempotent_creation_conflict

error, with the error including a links.conflicting_resource_id attribute pointing

to the already-existing resource.

Our API libraries will automatically generate idempotency keys when you try to create a resource. However, you might want to generate and supply your own - for example, using an ID from your database to identify a record (for example a payment you’re going to collect) will protect against not only network errors, but also accidentally doing the same thing twice from your side.

Idempotency keys may be no longer than 128 characters.

Idempotency keys are intended to prevent conflicts over short periods of time, and will not be persisted indefinitely. We guarantee that we will honour idempotency keys for at least 30 days. After this point we reserve the right to respect the keys for any further length of time and this behaviour must not be relied upon. We strongly encourage generating idempotency keys using UUIDv4 but any non-repeating unique identifier is sufficient.

Optional properties

When making requests, optional properties should be completely omitted from the JSON when not being used. This is automatically handled in our API libraries and is only relevant if you create your own.

Dates and Times

All timestamps are formatted as ISO8601 with timezone information. For API calls

that allow for a timestamp to be specified, we use that exact timestamp. These

timestamps look something like 2014-02-27T15:05:06.123Z.

For endpoints that require dates, we expect a date string of the format YYYY-MM-DD,

where an example would look like 2014-02-27.

Cursor Pagination

All list/index endpoints are ordered and paginated reverse chronologically by default.

Options

The following options are available on all cursor-paginated endpoints:

before- ID of the object immediately following the array of objects to be returned.

after- ID of the object immediately preceding the array of objects to be returned.

limit- Upper bound for the number of objects to be returned. Defaults to 50. Maximum of 500. Minimum of 1.

Response

Paginated results are always returned in an array, and include the following meta data:

before- The ID of the first resource that has been returned.

after- The ID of the last resource that has been returned.

limit- The upper bound placed on the number of objects returned. If there were not enough remaining objects in the list of data then fewer than this number will have been returned.

GET https://api.gocardless.com/resources?after=ID789 HTTP/1.1

HTTP/1.1 200 (OK)

Content-Type: application/json

{

"meta": {

"cursors": {

"after": "ID456",

"before": "ID123"

},

"limit": 50

},

"resources": [{

...

}]

}

Response Codes

You may encounter the following response codes. Any unsuccessful response codes will contain more information to help you identify the cause of the problem.

200- OK. The request has succeeded.

201- Created. The request has been fulfilled and resulted in a new resource being created. The newly created resource can be referenced by the URI(s) returned in the entity of the response, with the most specific URI for the resource given by a

Locationheader field. 204- No Content. The request was successful but no body was returned.

400- Bad Request. The request could not be understood by the server, usually due to malformed syntax. The response body will contain more details in the form of an array.

401- Unauthorized. The client has not provided a valid

AuthenticationHTTP header or the user making the request has been disabled. 403- Forbidden. The client has provided a valid

Authenticationheader, but does not have permission to access this resource. 404- Not Found. The requested resource was not found or the authenticated user cannot access the resource. The response body will explain which resource was not found.

405- Method Not Allowed. The HTTP verb used, or resource requested is not allowed. Note that we do not allow the

PATCHverb to be used, andPUTshould be used instead. 406- Not Acceptable. The content type specified in the

Acceptheader was not acceptable to this endpoint. 409- Conflict. The resource to be created by your request already exists.

410- Gone. The authenticated user can access the requested resource, but it has been removed. The response body will explain which resource has been removed.

415- Unsupported Media Type. The response error will explain what types are accepted.

422- Unprocessable Entity. Could not process a

POSTorPUTrequest because the request is invalid. The response body will contain more details. 426- Upgrade Required. An unsecured connection was refused. Upgrade to TLS/SSL.

429- Too Many Requests. A rate limit has been reached. The headers will explain the details of the rate limit.

500- Internal Server Error. The server encountered an error while processing your request and failed. Please retry the request. If the problem persists, please report this to the GoCardless support team and quote the

request_id. 504- Gateway Timeout. The request timed out and should be retried. If the problem persists, please report this to the GoCardless support team and quote the

request_id.

Scenario Simulators

When you’re building an integration with the API, there are some common paths you should make sure your integration handles successfully.

In the sandbox environment, we provide scenario simulators which allow you to manually trigger certain cases (like a customer cancelling their mandate or a payment failing due to lack of funds) from the Dashboard so you can test how your integration responds.

To find out more, see our scenario simulators guide.

Errors

Every error includes a type, the HTTP status code, a short message, a

documentation_url, linking to the relevant section of this document, and a

unique request_id which can be used to help the GoCardless support team

find your error quickly.

There is also an errors key which is an array listing any errors that have

been raised in one of two formats.

When the type is validation_failed, each error will be composed of a field

and a message describing what is wrong with that field.

For all other errors, the structure will contain a reason and a message

describing what the problem encountered.

There are 4 types of errors, depending on the root cause. These are:

Error types

gocardless- This is an error that has occured within GoCardless while processing your requests. In some cases, depending on the specific issue highlighted in

errors, the request should be retried. If the problem persists, it should be reported to our support team with therequest_id, so we can resolve the issue. invalid_api_ usage - This is an error with the request you made. It could be an invalid URL, the authentication header could be missing, invalid, or grant insufficient permissions, you may have reached your rate limit, or the syntax of your request could be incorrect. The

errorswill give more detail of the specific issue. invalid_state - The action you are trying to perform is invalid due to the state of the resource you are requesting it on. For example, a payment you are trying to cancel might already have been submitted. The

errorswill give more details.

validation_failed - The parameters submitted with your request were invalid. Details of which fields were invalid and why are included in the response. The

request_pointerparameter indicates the exact field of the request that triggered the validation error.

These four types should be handled very differently: gocardless errors should send an alert to your dev team, or directly to GoCardless support; invalid_api_usage should send an alert to your dev team; invalid_state should alert the end user and not allow them to retry; validation_failed should alert the end user and prompt them to correct their input.

GoCardless errors

internal_server_ error - An internal error occurred while processing your request. This should be reported to our support team with the

request_id, so we can resolve the issue.

request_timed_ out - The request did not complete within a reasonable time. In this case, the request should be retried (possibly with different parameters). If the problem persists, it should be reported to our support team with the

request_id, so we can resolve the issue.

query_timed_ out - The query for this request did not complete within a reasonable time, potentially due to being too complex. In this case, the request should be retried (possibly with different parameters). If the problem persists, it should be reported to our support team with the

request_id, so we can resolve the issue.

Invalid API usage errors

invalid_type - The

errorskey may also hold an array of type errors if the JSON you sent was incorrectly typed. These are in the same format as validation errors (with amessageandfieldper error). A type error will also be returned if you include any additional, unknown parameters.

path_not_ found - The path was not recognised. Check that you spelled the resource name correctly, and that the URL is formatted correctly.

resource_not_ found - The ID in the request was not found in our database.

link_not_ found - One of the

link[resource]IDs in the request was not found. Your integration should ensure that end users can only use existing resources.

unauthorized- Your username/password was not recognised.

forbidden- You were authenticated, but you do not have permission to access that resource.

feature_disabled - You are trying to use a feature which hasn’t been enabled on your account. Please contact support if you would like to enable it.

not_acceptable - The content type specified in your

Acceptheader was not acceptable to this endpoint.

request_entity_ too_ large - The body of your request is too large.

unsupported_media_ type - The API communicates using JSON only. Make sure that your

Acceptheader permits JSON, and yourContent-Typeheader is supported, if you are sending JSON data (e.g. with aPOSTorPUTrequest).

rate_limit_ exceeded - You have exceeded the rate limit. See the included headers for when your rate limit will be reset.

access_token_ not_ found - No access token with the ID specified was found.

access_token_ not_ active - The access token you are using has been disabled.

access_token_ revoked - The access token you are using has been revoked by the user.

missing_authorization_ header - No

Authorizationheader was included in your request. See making requests for details on how to structure your authorisation header.

invalid_authorization_ header - The

Authorizationheader sent was not valid. Make sure it was constructed as described in making requests.

insufficient_permissions - The access token you are using does not have the right scope to perform the requested action.

method_not_ allowed - The HTTP verb used is not permitted. Note that we do not allow

PATCHrequests, andPUTmust be used to update resources.

bad_request - The request syntax was incorrect.

idempotency_key_ too_ long - An idempotency key was supplied for this request but exceeded the max length of this key. See idempotency keys for details on how to work with idempotency.

invalid_document_ structure - The JSON sent to the server was not in the correct structure. Note that JSON parameters may not be sent at the top level, but must be sent under the name of the resource. See the examples for details on how this is done for each endpoint.

invalid_content_ type - When including a JSON body with a request you must also include a

Content-Typeheader, set toapplication/jsonorapplication/vnd.api+json.

tls_required - The GoCardless API can only be accessed over TLS/SSL. Make sure you are sending requests to urls starting with

https://, nothttp://.

missing_version_ header - No

GoCardless-Versionheader was included in your request. See making requests for details on how to set your version header.

version_not_ found - The

GoCardless-Versionspecified was not found. The version must be one of those listed in the changelog.

invalid_filters - The combination of filters specified in the query string of your request are not allowed. Only certain combinations of filters may be applied to each list endpoint, as documented on each endpoint.

request_body_ not_ allowed - Sending a request body is not supported for the HTTP method you have used. Use query string parameters in the URL instead.

customer_data_ removed - The customer has been removed and they can no longer be returned by our API. You should remove any GoCardless references to these objects in your systems.

payout_items_ data_ archived - Payout items for payouts created more than 6 months ago have been archived. Please contact support if you require access to this data.

Invalid state errors

cancellation_failed - The mandate, payment or subscription was not in a cancellable state. It might have already been cancelled, failed, or it might be too late in the submission process to cancel. For example, payments cannot be cancelled once they are submitted to the banks.

retry_failed - The payment could not be retried.

disable_failed - The customer or creditor bank account could not be disabled, as it is already disabled.

mandate_is_ inactive - The payment could not be created, because the mandate linked is cancelled, failed, or expired.

mandate_replaced - The resource could not be created, because the mandate it links to has been replaced (for example, because the creditor has moved to a new Service User Number). The new mandate can be found through the reference to

links[new_mandate]in the error response, or by retrieving the original mandate and checkinglinks[new_mandate].

bank_account_ disabled - The mandate could not be created because the customer bank account linked is disabled.

mandate_not_ inactive - The mandate could not be reinstated, because it is already being submitted, or is active.

refund_is_ unreachable - The refund could not be created, because it would not reach the target bank account.

refund_payment_ invalid_ state - The refund could not be created, because the payment specified is not

confirmedorpaid_out.

total_amount_ confirmation_ invalid - The refund could not be created because the total amount refunded does not match.

number_of_ refunds_ exceeded - The refund could not be created because five refunds have already been created for the given payment.

idempotent_creation_ conflict - The resource has not been created as a resource has already been created with the supplied idempotency key. See idempotency keys for details.

customer_bank_ account_ token_ used - The customer bank account could not be created because the token given has already been used.

billing_request_ must_ be_ ready_ to_ fulfil -

The billing request must have no outstanding required actions. To check the actions please view the actions array in the billing request get response.

Validation errors

The errors key may also hold an array of individual validation failures in

this case, or one of the following errors.

bank_account_ exists - The customer or creditor bank account you are trying to create already exists. These resources must be unique.

You should use the corresponding update endpoints to update the details on the existing bank account instead, which will be referenced aslinks[customer_bank_account]orlinks[creditor_bank_account](as appropriate) in the error response.

available_refund_ amount_ insufficient - The refund requested by the creditor could not be created for the given currency, because the creditor does not have a sufficient balance available to cover the cost of the refund.

The amount available for refunds will fluctuate over time, as it is calculated in real time using several indicators. Examples of such indicators are in-flight payments, pending refunds, and any applicable ‘buffer allowance’ provided by GoCardless for the creditor in the given currency. The amount available for refunds will be returned in themetadataof the error response, under theavailable_refund_amountkey, in the lowest denomination for the currency (e.g. pence in GBP, cents in EUR).

POST https://api.gocardless.com/customer_bank_accounts HTTP/1.1

Content-Type: application/json

{

"customer_bank_accounts": {

"account_number": "55779911",

"branch_code": "I'm not a sort code",

"account_holder_name": "Frank Osborne",

"country_code": "GB",

"links": {

"customer": "CU123"

}

}

}

HTTP/1.1 422 (Unprocessable Entity)

Content-Type: application/json

{

"error": {

"documentation_url": "https://developer.gocardless.com/#validation_failed",

"message": "Validation failed",

"type": "validation_failed",

"code": 422,

"request_id": "dd50eaaf-8213-48fe-90d6-5466872efbc4",

"errors": [

{

"message": "must be a number",

"field": "branch_code",

"request_pointer": "/customer_bank_accounts/branch_code"

}, {

"message": "is the wrong length (should be 8 characters)",

"field": "branch_code",

"request_pointer": "/customer_bank_accounts/branch_code"

}

]

}

}

POST https://api.gocardless.com/customer_bank_accounts HTTP/1.1

Content-Type: application/json

{

"customer_bank_accounts": {

"account_number": "55779911",

"branch_code": "200000",

"account_holder_name": "Frank Osborne",

"country_code": "GB",

"links": {

"customer": "CU123"

}

}

}

HTTP/1.1 400 (Bad Request)

Content-Type: application/json

{

"error": {

"message": "Invalid document structure",

"documentation_url": "https://developer.gocardless.com/#invalid_document_structure",

"type": "invalid_api_usage",

"request_id": "bd271b37-a2f5-47c8-b461-040dfe0e9cb1",

"code": 400,

"errors": [

{

"reason": "invalid_document_structure",

"message": "Invalid document structure"

}

]

}

}

POST https://api.gocardless.com/creditor_bank_accounts HTTP/1.1

Content-Type: application/json

{

"creditor_bank_accounts": {

"account_number": "55779911",

"branch_code": "200000",

"country_code": "GB",

"set_as_default_payout_account": true,

"account_holder_name": "Nude Wines",

"links": {

"creditor": "CR123"

}

}

}

HTTP/1.1 409 (Conflict)

Content-Type: application/json

{

"error": {

"message": "Bank account already exists",

"documentation_url": "https://developer.gocardless.com/#bank_account_exists",

"type": "validation_failed",

"request_id": "bd271b37-a2f5-47c8-b461-040dfe0e9cb1",

"code": 409,

"errors": [

{

"reason": "bank_account_exists",

"message": "Bank account already exists",

"links": {

"creditor_bank_account": "BA123"

}

}

]

}

}

Billing Requests

This section contains API endpoints that are used to power Billing Requests.

Billing Requests help create resources that require input or action from a customer. An example of required input might be additional customer billing details, while an action would be asking a customer to authorise a payment using their mobile banking app.

Billing Requests go through a simple lifecycle, with the state exposed as the

status field:

-

pending, actions need completing before we can fulfil -

ready_to_fulfil, all required actions are complete and the integrator may fulfil this request -

fulfilled, the request is fulfilled and an resource has been created -

cancelled, request was cancelled before it can be completed (no resource will ever be created)

Integrators have a choice between building their own user experience flows to complete the required actions, or creating a Billing Request Flow against the Billing Request. Billing Request Flows are a GoCardless managed flow that knows how to process outstanding actions on the Request, helping the customer provide their required details and fulfil the request.

We advise most integrators make use of Billing Request Flows to benefit from the efforts GoCardless put into optimising conversion, adapting to a changing regulatory environment, and to reduce integration effort.

Even for integrators who want a whitelabel experience, we might advise completing some actions through a customer integration and leveraging the Billing Request Flow to complete the more complex actions.

Bank Authorisations

Bank Authorisations can be used to authorise Billing Requests. Authorisations are created against a specific bank, usually the bank that provides the payer’s account.

Creation of Bank Authorisations is only permitted from GoCardless hosted UIs (see Billing Request Flows) to ensure we meet regulatory requirements for checkout flows.

Properties

id- Unique identifier, beginning with “BAU”.

authorisation_type - Type of authorisation, can be either ‘mandate’ or ‘payment’.

authorised_at - Fixed timestamp, recording when the user has been authorised.

created_at - Timestamp when the flow was created

expires_at - Timestamp when the url will expire. Each authorisation url currently lasts for 15 minutes, but this can vary by bank.

last_visited_ at - Fixed timestamp, recording when the authorisation URL has been visited.

qr_code_ url - URL to a QR code PNG image of the bank authorisation url.

This QR code can be used as an alternative to providing the

urlto the payer to allow them to authorise with their mobile devices. redirect_uri - URL that the payer can be redirected to after authorising the payment.

On completion of bank authorisation, the query parameter of either

outcome=successoroutcome=failurewill be appended to theredirect_urito indicate the result of the bank authorisation. If the bank authorisation is expired, the query parameteroutcome=timeoutwill be appended to theredirect_uri, in which case you should prompt the user to try the bank authorisation step again.The

redirect_uriyou provide should handle theoutcomequery parameter for displaying the result of the bank authorisation as outlined above.The BillingRequestFlow ID will also be appended to the

redirect_urias query parameterid=BRF123.Defaults to

https://pay.gocardless.com/billing/static/thankyou. url- URL for an oauth flow that will allow the user to authorise the payment

links[billing_ request] - ID of the billing request against which this authorisation was created.

links[institution] - ID of the institution against which this authorisation was created.

Create a Bank Authorisation

Create a Bank Authorisation.

Relative endpoint: POST /bank_authorisations

Restricted: this endpoint is restricted as the authorisation must be used within a

checkout flow that meets regulatory requirements for each payment

scheme. Integrators should use a Billing Request Flow to do this.

If you would like to enable bank authorisations, you will need to go through a separate compliance process.

For more details please get in touch.

Parameters

redirect_uri - URL that the payer can be redirected to after authorising the payment.

On completion of bank authorisation, the query parameter of either

outcome=successoroutcome=failurewill be appended to theredirect_urito indicate the result of the bank authorisation. If the bank authorisation is expired, the query parameteroutcome=timeoutwill be appended to theredirect_uri, in which case you should prompt the user to try the bank authorisation step again.The

redirect_uriyou provide should handle theoutcomequery parameter for displaying the result of the bank authorisation as outlined above.The BillingRequestFlow ID will also be appended to the

redirect_urias query parameterid=BRF123.Defaults to

https://pay.gocardless.com/billing/static/thankyou. links[billing_ request] - ID of the billing request against which this authorisation was created.

POST https://api.gocardless.com/bank_authorisations HTTP/1.1

Content-Type: application/json

{

"bank_authorisations": {

"redirect_uri": "https://my-company.com/landing",

"links": {

"billing_request": "BRQ123"

}

}

}

HTTP/1.1 201 Created

Location: /bank_authorisations/BAU123

Content-Type: application/json

{

"bank_authorisations": {

"id": "BAU123",

"url": "https://pay-staging.gocardless.com/obauth/BAU123",

"qr_code_url": "https://pay-staging.gocardless.com/obauth/BAU123/qr_code",

"created_at": "2021-03-25T17:26:28.305Z",

"authorisation_type": "payment",

"last_visited_at": null,

"authorised_at": null,

"expires_at": "2021-03-25T17:41:28.000Z",

"redirect_uri": "https://my-company.com/landing",

"links": {

"billing_request": "BRQ123",

"institution": "monzo"

}

}

}

$client = new \GoCardlessPro\Client([

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

]);

$client->bankAuthorisations()->create([

"params" => [

"redirect_uri" => "https://my-company.com/landing",

"links" => [

"billing_request" => "BRQ123"

]

]

]);

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.bank_authorisations.create(params={

"redirect_uri": "https://my-company.com/landing",

"links": {

"billing_request": "BRQ123"

}

})

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.bank_authorisations.create(

params: {

redirect_uri: "https://my-company.com/landing",

links: {

billing_request: "BRQ123"

}

}

)

import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

BankAuthorisation bankAuthorisation = client.bankAuthorisations().create()

.withRedirectUri("https://my-company.com/landing")

.withLinksBillingRequest("BRQ123")

.execute();

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const bankAuthorisation = await client.bankAuthorisations.create({

redirect_uri: "https://my-company.com/landing",

links: {

billing_request: "BRQ123"

}

});

String accessToken = "your_access_token";

GoCardlessClient gocardless = GoCardlessClient.Create(accessToken, Environment.SANDBOX);

var authorisationLinks = new gocardless.BankAuthorisationCreateRequest.BankAuthorisationLinks

{

BillingRequest = "BRQ123"

};

var resp = await gocardless.BankAuthorisations.CreateAsync(

new GoCardless.Services.BankAuthorisationCreateRequest()

{

RedirectUri = "https://my-company.com/landing",

links = authorisationLinks,

}

);

GoCardless.Resources.BankAuthorisation bankAuthorisation = resp.BankAuthorisation;

package main

import (

gocardless "github.com/gocardless/gocardless-pro-go/v2"

)

func main() {

accessToken := "your_access_token_here"

config, err := gocardless.NewConfig(accessToken, gocardless.WithEndpoint(gocardless.SandboxEndpoint))

if err != nil {

fmt.Printf("got err in initialising config: %s", err.Error())

return

}

client, err := gocardless.New(config)

if err != nil {

fmt.Println("error in initialisating client: %s", err.Error())

return

}

bankAuthorisationCreateParams := gocardless.BankAuthorisationCreateParams{

RedirectUri: "https://my-company.com/landing",

Links: gocardless.BankAuthorisationCreateParamsLinks{

BillingRequest: "BR123",

},

}

bankAuthorisation, err := client.BankAuthorisations.Create(context, bankAuthorisationCreateParams)

}

Get a Bank Authorisation

Get a single bank authorisation.

Relative endpoint: GET /bank_authorisations/BAU123

GET https://api.gocardless.com/bank_authorisations/BAU123 HTTP/1.1

HTTP/1.1 200

Content-Type: application/json

{

"bank_authorisations": {

"id": "BAU123",

"url": "https://pay-staging.gocardless.com/obauth/BAU123",

"qr_code_url": "https://pay-staging.gocardless.com/obauth/BAU123/qr_code",

"created_at": "2021-03-25T17:26:28.305Z",

"authorisation_type": "payment",

"last_visited_at": null,

"authorised_at": null,

"expires_at": "2021-03-25T17:41:28.000Z",

"redirect_uri": "https://my-company.com/landing",

"links": {

"billing_request": "BRQ123",

"institution": "monzo"

}

}

}

$client = new \GoCardlessPro\Client([

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

]);

$client->bankAuthorisations()->get("BAU123");

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.bank_authorisations.get("BAU123")

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.bank_authorisations.get("BAU123")

import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

client.bankAuthorisations().get("BAU123").execute();

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const resp = await client.bankAuthorisations.find("BAU123");

String accessToken = "your_access_token";

GoCardlessClient gocardless = GoCardlessClient.Create(accessToken, Environment.SANDBOX);

var resp = await gocardless.BankAuthorisations.GetAsync("BAU123");

package main

import (

gocardless "github.com/gocardless/gocardless-pro-go/v2"

)

func main() {

accessToken := "your_access_token_here"

config, err := gocardless.NewConfig(accessToken, gocardless.WithEndpoint(gocardless.SandboxEndpoint))

if err != nil {

fmt.Printf("got err in initialising config: %s", err.Error())

return

}

client, err := gocardless.New(config)

if err != nil {

fmt.Println("error in initialisating client: %s", err.Error())

return

}

bankAuthorisation, err := client.BankAuthorisations.Get(context, "BAU123")

}

Billing Requests

Billing Requests help create resources that require input or action from a customer. An example of required input might be additional customer billing details, while an action would be asking a customer to authorise a payment using their mobile banking app.

See Billing Requests: Overview for how-to’s, explanations and tutorials.

Properties

id- Unique identifier, beginning with “BRQ”.

actions- List of actions that can be performed before this billing request can be fulfilled.

Each instance will contain these properties:

-

available_currencies: List of currencies the current mandate supports -

bank_authorisation: Describes the behaviour of bank authorisations, for the bank_authorisation action -

collect_customer_details: Additional parameters to help complete the collect_customer_details action -

completes_actions: Which other action types this action can complete. -

institution_guess_status: Describes whether we inferred the institution from the provided bank account details. One of:-

not_needed: we won’t attempt to infer the institution as it is not needed. Either because it was manually selected or the billing request does not support this feature -

pending: we are waiting on the bank details in order to infer the institution -

failed: we weren’t able to infer the institution -

success: we inferred the institution and added it to the resources of a Billing Request

-

-

required: Informs you whether the action is required to fulfil the billing request or not. -

requires_actions: Requires completing these actions before this action can be completed. -

status: Status of the action -

type: Unique identifier for the action.

-

created_at - Fixed timestamp, recording when this resource was created.

fallback_enabled - (Optional) If true, this billing request can fallback from instant payment to direct debit.

Should not be set if GoCardless payment intelligence feature is used.

See Billing Requests: Retain customers with Fallbacks for more information.

mandate_request [authorisation_ source] - This field is ACH specific, sometimes referred to as SEC code.

This is the way that the payer gives authorisation to the merchant. web: Authorisation is Internet Initiated or via Mobile Entry (maps to SEC code: WEB) telephone: Authorisation is provided orally over telephone (maps to SEC code: TEL) paper: Authorisation is provided in writing and signed, or similarly authenticated (maps to SEC code: PPD)

constraints[end_ date] - The latest date at which payments can be taken, must occur after start_date if present

This is an optional field and if it is not supplied the agreement will be considered open and will not have an end date. Keep in mind the end date must take into account how long it will take the user to set up this agreement via the Billing Request.

constraints[max_ amount_ per_ payment] - The maximum amount that can be charged for a single payment. Required for VRP.

periodic_limits - List of periodic limits and constraints which apply to them

Each instance will contain these properties:

-

alignment: The alignment of the period.calendar- this will finish on the end of the current period. For example this will expire on the Monday for the current week or the January for the next year.creation_date- this will finish on the next instance of the current period. For example Monthly it will expire on the same day of the next month, or yearly the same day of the next year. -

max_payments: (Optional) The maximum number of payments that can be collected in this periodic limit. -

max_total_amount: The maximum total amount that can be charged for all payments in this periodic limit. Required for VRP. -

period: The repeating period for this mandate

-

constraints[start_ date] - The date from which payments can be taken.

This is an optional field and if it is not supplied the start date will be set to the day authorisation happens.

mandate_request [currency] - ISO 4217 currency code.

mandate_request [description] - A human-readable description of the payment and/or mandate. This will be displayed to the payer when authorising the billing request.

links[mandate] - (Optional) ID of the mandate that was created from this mandate request. this mandate request.

mandate_request [metadata] - Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

mandate_request [payer_ requested_ dual_ signature] - This attribute can be set to true if the payer has indicated that multiple signatures are required for the mandate. As long as every other Billing Request actions have been completed, the payer will receive an email notification containing instructions on how to complete the additional signature. The dual signature flow can only be completed using GoCardless branded pages.

mandate_request [scheme] - A bank payment scheme. Currently “ach”, “autogiro”, “bacs”, “becs”, “becs_nz”, “betalingsservice”, “faster_payments”, “pad”, “pay_to” and “sepa_core” are supported. Optional for mandate only requests - if left blank, the payer will be able to select the currency/scheme to pay with from a list of your available schemes.

mandate_request [verify] - Verification preference for the mandate. One of:

-

minimum: only verify if absolutely required, such as when part of scheme rules -

recommended: in addition tominimum, use the GoCardless payment intelligence solution to decide if a payer should be verified -

when_available: if verification mechanisms are available, use them -

always: aswhen_available, but fail to create the Billing Request if a mechanism isn’t available

-

By default, all Billing Requests use the recommended verification preference. It uses GoCardless payment intelligence solution to determine if a payer is fraudulent or not. The verification mechanism is based on the response and the payer may be asked to verify themselves. If the feature is not available, recommended behaves like minimum.

If you never wish to take advantage of our reduced risk products and Verified Mandates as they are released in new schemes, please use the minimum verification preference.

See Billing Requests: Creating Verified Mandates for more information.

metadata- Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

payment_request [amount] - Amount in minor unit (e.g. pence in GBP, cents in EUR).

payment_request [app_ fee] - The amount to be deducted from the payment as an app fee, to be paid to the partner integration which created the billing request, in the lowest denomination for the currency (e.g. pence in GBP, cents in EUR).

payment_request [currency] -

ISO 4217 currency code.

GBPandEURsupported;GBPwith your customers in the UK and forEURwith your customers in supported Eurozone countries only. payment_request [description] - A human-readable description of the payment and/or mandate. This will be displayed to the payer when authorising the billing request.

payment_request [funds_ settlement] - This field will decide how GoCardless handles settlement of funds from the customer.

-

managedwill be moved through GoCardless’ account, batched, and payed out. -

directwill be a direct transfer from the payer’s account to the merchant where invoicing will be handled separately.

-

links[payment] - (Optional) ID of the payment that was created from this payment request.

payment_request [metadata] - Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

payment_request [scheme] - (Optional) A scheme used for Open Banking payments. Currently

faster_paymentsis supported in the UK (GBP) andsepa_credit_transferandsepa_instant_credit_transferare supported in supported Eurozone countries (EUR). For Eurozone countries,sepa_credit_transferis used as the default. Please be aware thatsepa_instant_credit_transfermay incur an additional fee for your customer. purpose_code - Specifies the high-level purpose of a mandate and/or payment using a set of pre-defined categories. Required for the PayTo scheme, optional for all others. Currently

mortgage,utility,loan,dependant_support,gambling,retail,salary,personal,government,pension,taxandotherare supported. customer[company_ name] - Customer’s company name. Required unless a

given_nameandfamily_nameare provided. For Canadian customers, the use of acompany_namevalue will mean that any mandate created from this customer will be considered to be a “Business PAD” (otherwise, any mandate will be considered to be a “Personal PAD”). customer[created_ at] - Fixed timestamp, recording when this resource was created.

customer[email] - Customer’s email address. Required in most cases, as this allows GoCardless to send notifications to this customer.

customer[family_ name] - Customer’s surname. Required unless a

company_nameis provided. customer[given_ name] - Customer’s first name. Required unless a

company_nameis provided. customer[id] - Unique identifier, beginning with “CU”.

customer[language] -

ISO 639-1 code. Used as the language for notification emails sent by GoCardless if your organisation does not send its own (see compliance requirements). Currently only “en”, “fr”, “de”, “pt”, “es”, “it”, “nl”, “da”, “nb”, “sl”, “sv” are supported. If this is not provided, the language will be chosen based on the

country_code(if supplied) or default to “en”. customer[metadata] - Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

customer[phone_ number] - ITU E.123 formatted phone number, including country code.

customer_bank_ account [account_ holder_ name] - Name of the account holder, as known by the bank. This field will be transliterated, upcased and truncated to 18 characters. This field is required unless the request includes a customer bank account token.

customer_bank_ account [account_ number_ ending] - The last few digits of the account number. Currently 4 digits for NZD bank accounts and 2 digits for other currencies.

customer_bank_ account [account_ type] - Bank account type. Required for USD-denominated bank accounts. Must not be provided for bank accounts in other currencies. See local details for more information.

customer_bank_ account [bank_ name] - Name of bank, taken from the bank details.

customer_bank_ account [country_ code] -

ISO 3166-1 alpha-2 code. Defaults to the country code of the

ibanif supplied, otherwise is required. customer_bank_ account [created_ at] - Fixed timestamp, recording when this resource was created.

customer_bank_ account [currency] - ISO 4217 currency code. Currently “AUD”, “CAD”, “DKK”, “EUR”, “GBP”, “NZD”, “SEK” and “USD” are supported.

customer_bank_ account [enabled] - Boolean value showing whether the bank account is enabled or disabled.

customer_bank_ account [id] - Unique identifier, beginning with “BA”.

links[customer] - ID of the customer that owns this bank account.

customer_bank_ account [metadata] - Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

customer_billing_ detail [address_ line1] - The first line of the customer’s address.

customer_billing_ detail [address_ line2] - The second line of the customer’s address.

customer_billing_ detail [address_ line3] - The third line of the customer’s address.

customer_billing_ detail [city] - The city of the customer’s address.

customer_billing_ detail [country_ code] - ISO 3166-1 alpha-2 code.

customer_billing_ detail [created_ at] - Fixed timestamp, recording when this resource was created.

customer_billing_ detail [danish_ identity_ number] - For Danish customers only. The civic/company number (CPR or CVR) of the customer. Must be supplied if the customer’s bank account is denominated in Danish krone (DKK).

customer_billing_ detail [id] - Unique identifier, beginning with “CU”.

customer_billing_ detail [ip_ address] - For ACH customers only. Required for ACH customers. A string containing the IP address of the payer to whom the mandate belongs (i.e. as a result of their completion of a mandate setup flow in their browser).

Not required for creating offline mandates where

authorisation_sourceis set to telephone or paper. customer_billing_ detail [postal_ code] - The customer’s postal code.

customer_billing_ detail [region] - The customer’s address region, county or department. For US customers a 2 letter ISO3166-2:US state code is required (e.g.

CAfor California). schemes- The schemes associated with this customer billing detail

customer_billing_ detail [swedish_ identity_ number] - For Swedish customers only. The civic/company number (personnummer, samordningsnummer, or organisationsnummer) of the customer. Must be supplied if the customer’s bank account is denominated in Swedish krona (SEK). This field cannot be changed once it has been set.

status- One of:

-

pending: the billing request is pending and can be used -

ready_to_fulfil: the billing request is ready to fulfil -

fulfilling: the billing request is currently undergoing fulfilment -

fulfilled: the billing request has been fulfilled and a payment created -

cancelled: the billing request has been cancelled and cannot be used

-

links[bank_ authorisation] - (Optional) ID of the bank authorisation that was used to verify this request.

links[creditor] - ID of the associated creditor.

links[customer] - ID of the customer that will be used for this request

links[customer_ bank_ account] - (Optional) ID of the customer_bank_account that will be used for this request

links[customer_ billing_ detail] - ID of the customer billing detail that will be used for this request

links[mandate_ request] - (Optional) ID of the associated mandate request

links[mandate_ request_ mandate] - (Optional) ID of the mandate that was created from this mandate request. this mandate request.

links[organisation] - ID of the associated organisation.

links[payment_ provider] - (Optional) ID of the associated payment provider

links[payment_ request] - (Optional) ID of the associated payment request

links[payment_ request_ payment] - (Optional) ID of the payment that was created from this payment request.

Create a Billing Request

Relative endpoint: POST /billing_requests

Note: Instant Bank Pay is only available for transactions in GBP with your customers in the UK and for EUR with your customers in supported Eurozone countries. We will be adding other countries soon.

Warning: by default, the ability to provide a custom mandate reference is switched off. The banking system rules for valid references are quite complex, and we recommend allowing GoCardless to generate it. If you would like to provide custom references, please contact support.

Parameters

fallback_enabled - (Optional) If true, this billing request can fallback from instant payment to direct debit.

Should not be set if GoCardless payment intelligence feature is used.

See Billing Requests: Retain customers with Fallbacks for more information.

mandate_request [authorisation_ source] - This field is ACH specific, sometimes referred to as SEC code.

This is the way that the payer gives authorisation to the merchant. web: Authorisation is Internet Initiated or via Mobile Entry (maps to SEC code: WEB) telephone: Authorisation is provided orally over telephone (maps to SEC code: TEL) paper: Authorisation is provided in writing and signed, or similarly authenticated (maps to SEC code: PPD)

mandate_request [constraints] - Constraints that will apply to the mandate_request. (Optional) Specifically for PayTo and VRP.

Properties:

-

end_date: The latest date at which payments can be taken, must occur after start_date if presentThis is an optional field and if it is not supplied the agreement will be considered open and will not have an end date. Keep in mind the end date must take into account how long it will take the user to set up this agreement via the Billing Request.

-

max_amount_per_payment: The maximum amount that can be charged for a single payment. Required for VRP. -

periodic_limits: List of periodic limits and constraints which apply to them -

start_date: The date from which payments can be taken.This is an optional field and if it is not supplied the start date will be set to the day authorisation happens.

-

mandate_request [currency] - ISO 4217 currency code.

mandate_request [description] - A human-readable description of the payment and/or mandate. This will be displayed to the payer when authorising the billing request.

mandate_request [metadata] - Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

mandate_request [reference] - Unique reference. Different schemes have different length and character set requirements. GoCardless will generate a unique reference satisfying the different scheme requirements if this field is left blank.

mandate_request [scheme] - A bank payment scheme. Currently “ach”, “autogiro”, “bacs”, “becs”, “becs_nz”, “betalingsservice”, “faster_payments”, “pad”, “pay_to” and “sepa_core” are supported. Optional for mandate only requests - if left blank, the payer will be able to select the currency/scheme to pay with from a list of your available schemes.

mandate_request [verify] - Verification preference for the mandate. One of:

-

minimum: only verify if absolutely required, such as when part of scheme rules -

recommended: in addition tominimum, use the GoCardless payment intelligence solution to decide if a payer should be verified -

when_available: if verification mechanisms are available, use them -

always: aswhen_available, but fail to create the Billing Request if a mechanism isn’t available

-

By default, all Billing Requests use the recommended verification preference. It uses GoCardless payment intelligence solution to determine if a payer is fraudulent or not. The verification mechanism is based on the response and the payer may be asked to verify themselves. If the feature is not available, recommended behaves like minimum.

If you never wish to take advantage of our reduced risk products and Verified Mandates as they are released in new schemes, please use the minimum verification preference.

See Billing Requests: Creating Verified Mandates for more information.

metadata- Key-value store of custom data. Up to 3 keys are permitted, with key names up to 50 characters and values up to 500 characters.

payment_request [amount] - Amount in minor unit (e.g. pence in GBP, cents in EUR).