GoCardless Protect+ is our anti-fraud payment intelligence product.

We have been processing bank debit payments for over a decade, giving us industry-leading payment intelligence data based on tens of billions of dollars worth of payments, including payments across 37 countries.

Using this data we detect, verify, monitor, and challenge payers across the lifecycle of your payments.

With GoCardless Protect+ you are able to:

detect suspected fraudulent payers using payment intelligence

use advanced open-banking functionality to verify suspected fraudulent payers, based on your risk profile

monitor fraudulent behaviour and its impact on your business

take actions against the suspected fraudulent payers such as challenging unfair chargebacks or blocking payers entirely

All of this helps you stay one step ahead in the fight against payment fraud.

In order to use Protect+, you must complete the below steps and ensure you have integrated with our Billing Request API, which offers our latest and most advanced features.

You will not be able to use Protect+ features if you miss any of the below steps.

Merchants:

Your organisation must have both the Protect+ and Verified Mandates upgrades enabled. Please get in contact with our support team to enable this.

Partners:

The upgrade needs to be enabled individually at the organisation level if any organisation connected or signed up using your app wants to use Protect+. You can do this by contacting our support team.

Merchants:

In order to use Protect+, you must be using the payment pages that are supported using Billing Requests API. You can use the payment pages in any of the below forms:

Partners:

You need to have one of the above integrations in place for the organisations connected to your app to start using and getting benefits from Protect+ features.

Once you have completed the requirements, listed in the steps above, you will be able to benefit from the range of Protect+ features, available via the Billing Requests API and the merchant dashboard.

With Protect+ you are able to reduce fraud by verifying payers that are deemed as potentially fraudulent. We use our Machine Learning capability to determine if a payer needs to be verified, due to their fraud risk, while they are going through one of the payment pages above.

As part of the verification, payers will be asked to authenticate themselves by logging into their bank account, to prove their account ownership.

You will need to set the verify preference to recommended when creating the Billing Request or Billing Request Template.

The recommended setting will combine our Machine Learning with your custom Risk Setting options to determine which payers will be sent for bank authentication.

If no option is specified, recommended will be used by default

More information about verified mandates and the countries which support this can be found here

If you are a Partner then setting verify to recommended will

Billing Request:

POST https://api.gocardless.com/billing_requests HTTP/1.1

{

"billing_requests": {

"mandate_request": {

"scheme": "bacs",

"verify": "recommended"

}

}

}

Billing Request Template:

POST https://api.gocardless.com/billing_request_templates HTTP/1.1

{

"billing_request_templates": {

"mandate_request_scheme": "bacs",

“mandate_request_verify”: “recommended”

"redirect_uri": "https://my-company.com/landing",

}

}

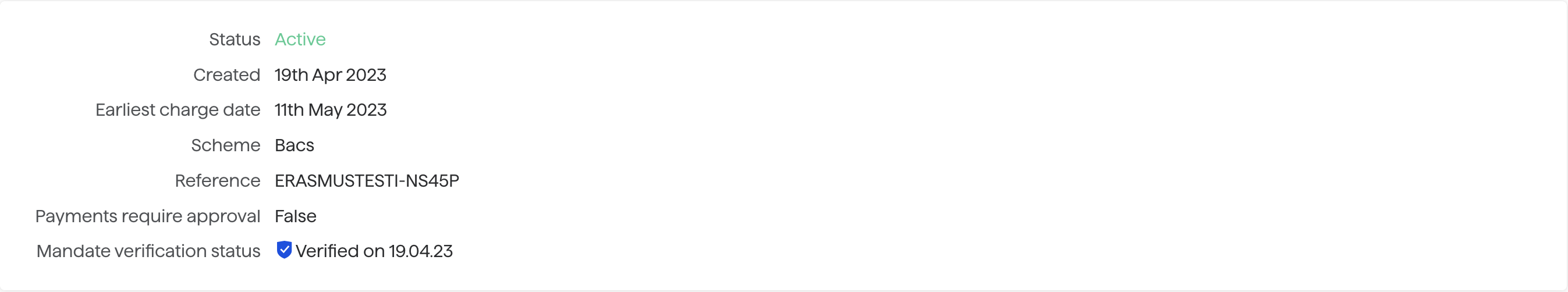

You can confirm that a payer has completed bank authorisation in three ways. Once complete:

the query parameter of either outcome=success or outcome=failure will be appended to the redirect_uri. If the bank authorisation has expired, the parameter will be set to outcome=timeout. The payer at this point can be prompted to try the bank authorisation step again (although this may be the result of a fraudulent payer being deterred).

responses through the mandate endpoints will contain the verified_at field with a timestamp of when the mandate was verified.

the mandate page will have its verification status displayed within the merchant dashboard:

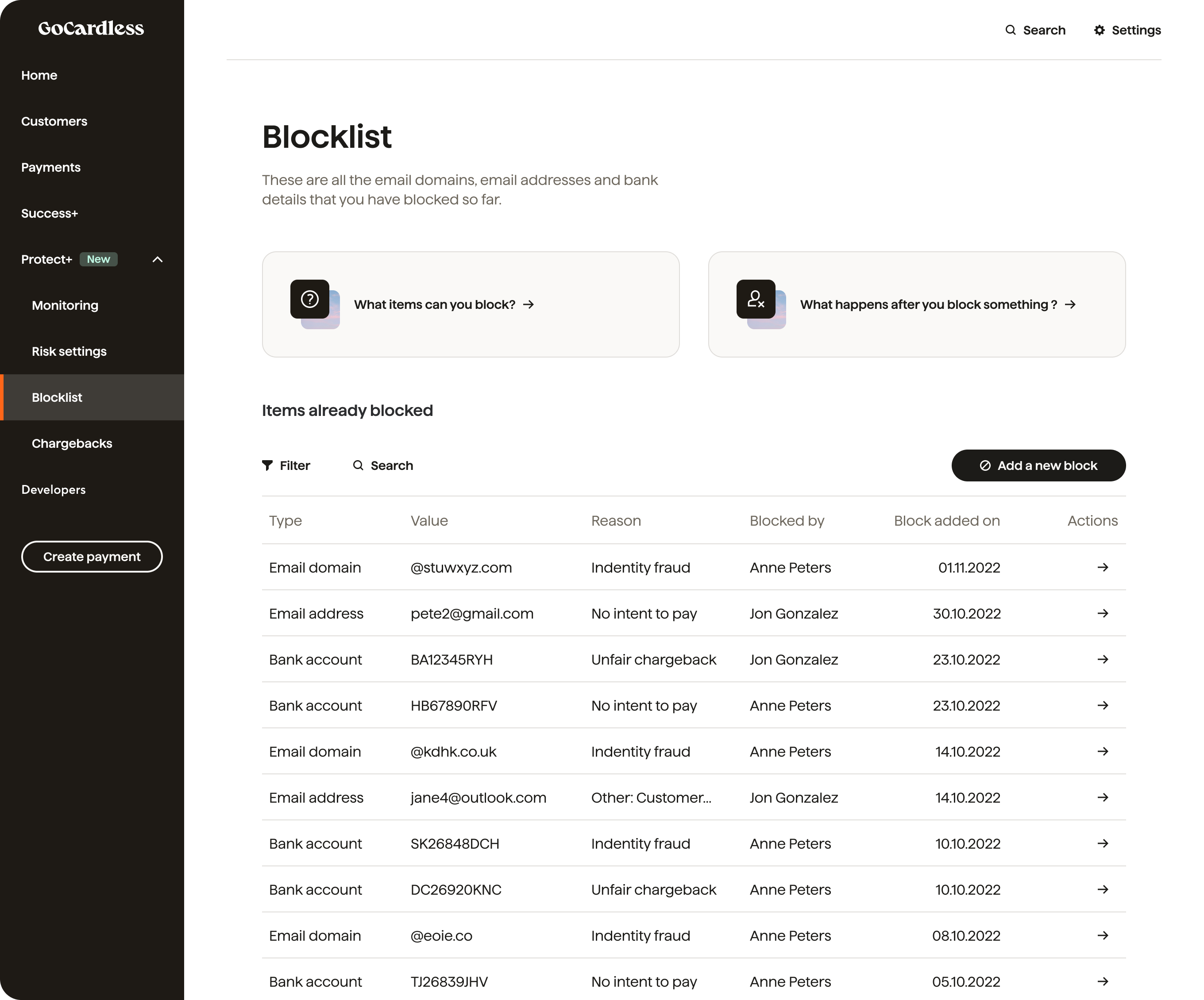

With Protect+, you are able to prevent certain customer details from being used when creating mandates. These include email domains, email addresses, and bank details.

This feature can be accessed using the API as well from the Blocklist page on the merchant dashboard (see below)

Under the Protect+ section of the merchant dashboard, you can access the below features.

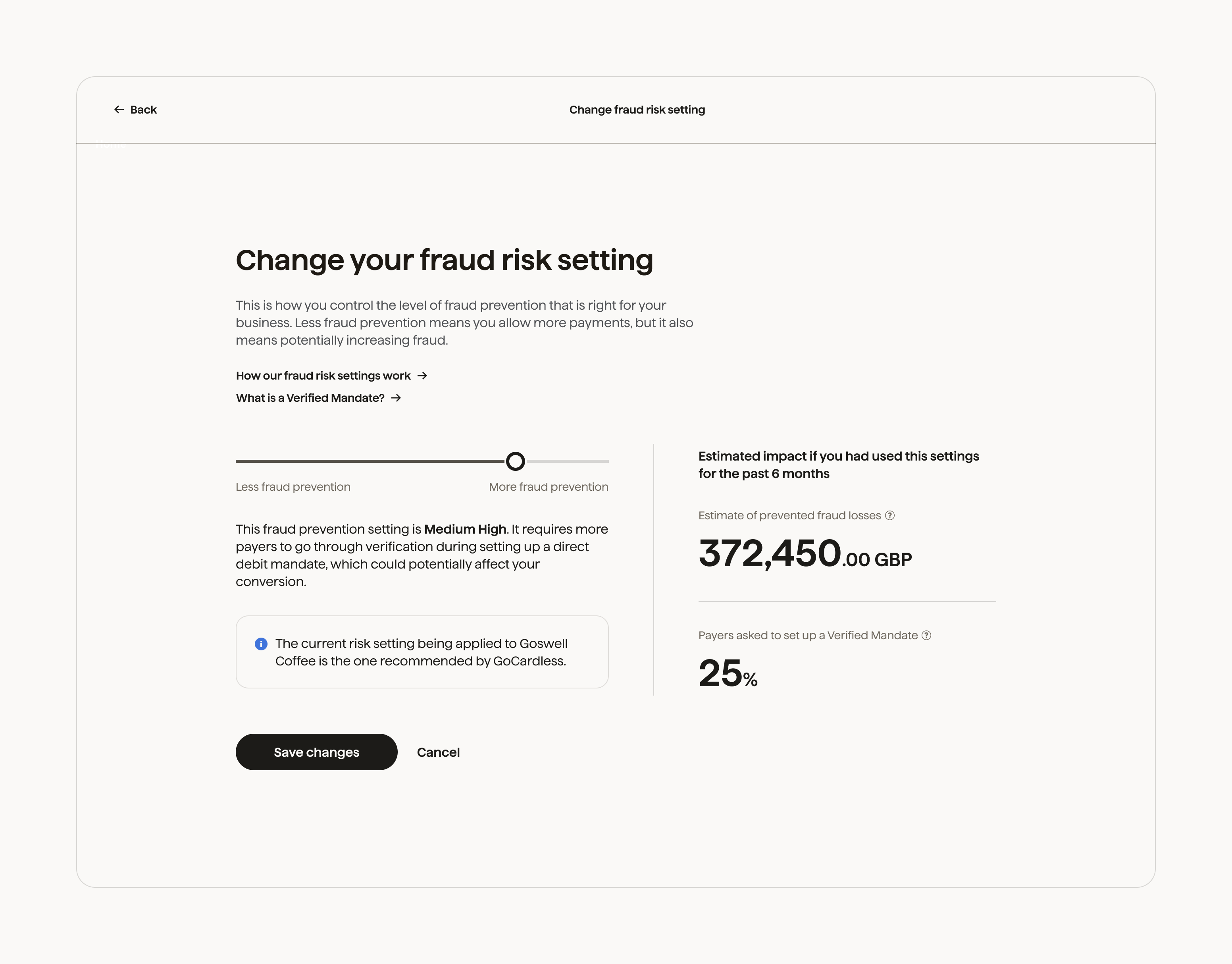

The Risk Settings page allows you to control the level of fraud prevention that is right for your business.

We combine the risk score returned by our Machine Learning model with the Risk Setting you have configured on the merchant dashboard to determine if a payer should be sent for verification.

A lower risk setting means fewer payers will be sent for verification checks, which could increase your exposure to fraud. On the other hand, a higher risk setting could impact conversion, which is why we have made it easy for you to specify the setting that matches your risk appetite.

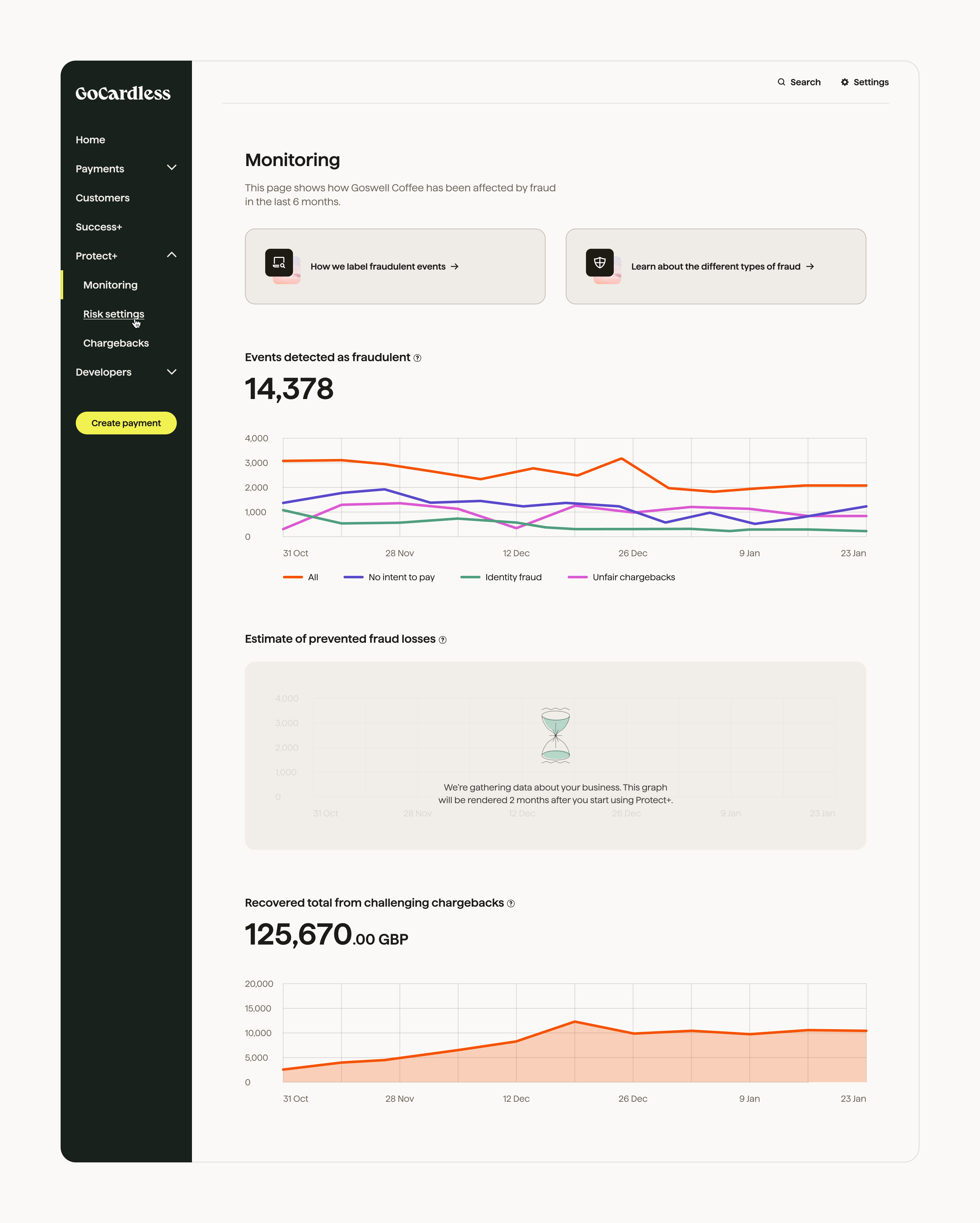

The Monitoring page allows you to:

Monitor the fraudulent activities affecting your account. This data will help you to decide which decisions to take to tackle fraud with the features offered by Protect+, such as challenging chargebacks, verifying payers, and blocking known fraudsters.

Easily visualise and understand the impact of Protect+ on your business.

If you are new to GoCardless, you may need to wait for your account to have at least two months of data before you can see some of the metrics.

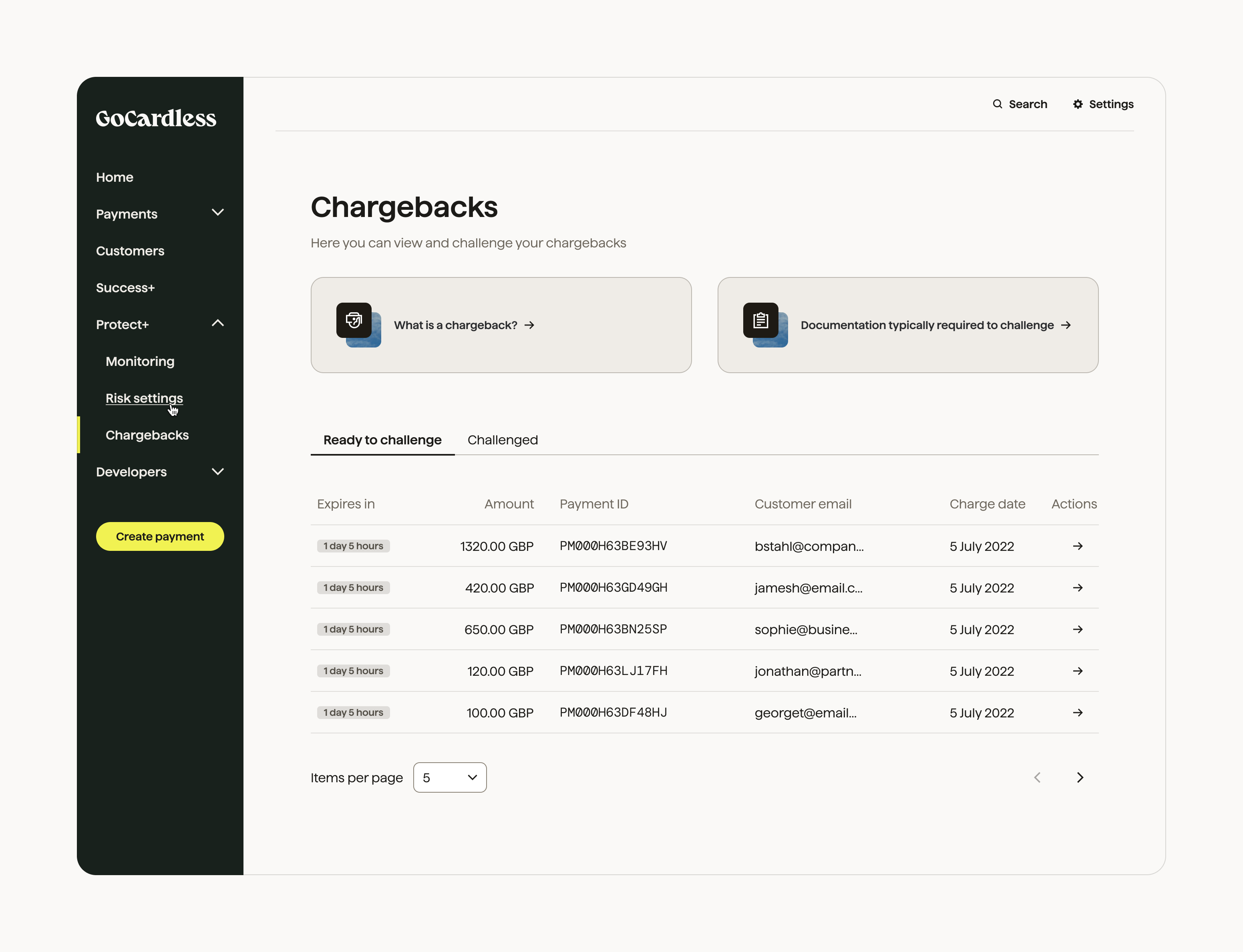

The Chargebacks page lists chargebacks by your customers, and allows you to challenge any which you believe have been unfairly charged back.

In this section, you can upload the required evidence to support your challenge, as well as track the status of any challenged chargeback.

The blocklist page enables you to block customers using certain details from setting up new mandates. You are able to block the email domain, email address, and bank details of suspected fraudsters. You can also use the mandate ID or customer ID to block the email address and bank account details linked to that customer.

On the blocklist page, you can:

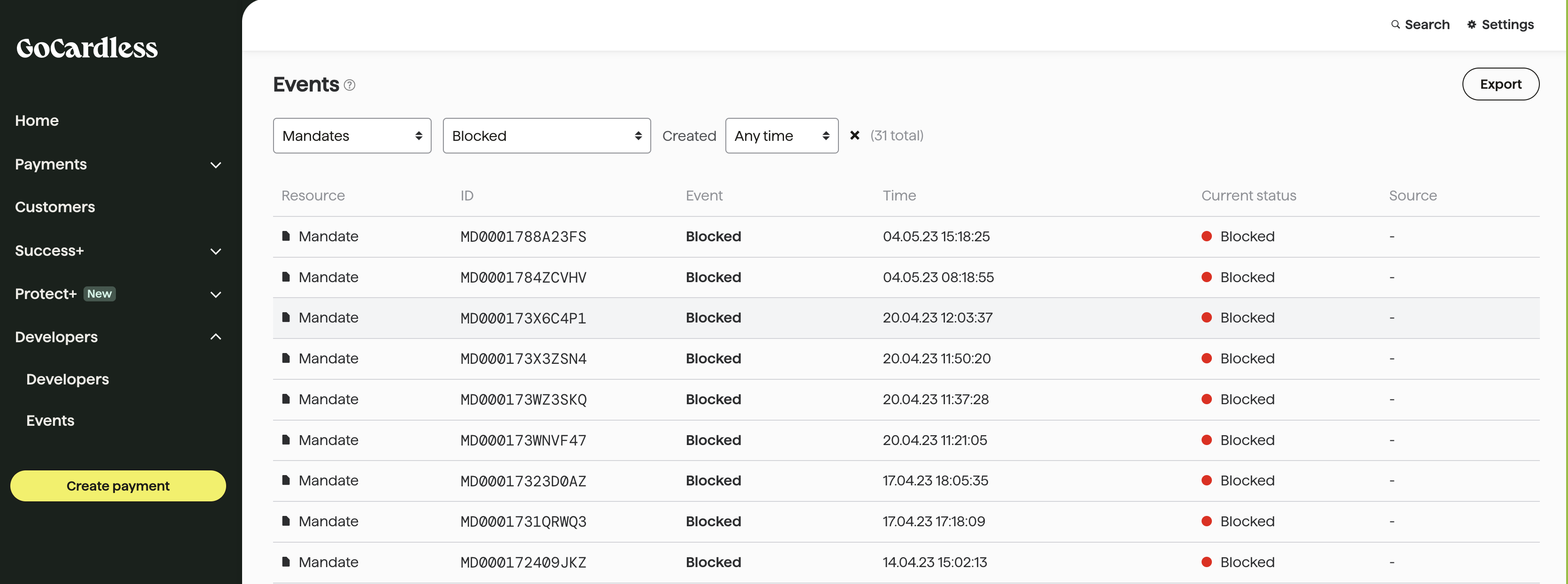

All blocked mandates can be viewed under the Events page of the merchant dashboard using the ‘Blocked’ filter for Mandates.