Guides

Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandateBilling Requests

What is a Billing Request

A Billing Request enables you to collect all types of GoCardless payments using the Billing Request Flow API. This includes both one-off and recurring payments from your new or existing customers.

Quick definitions:

Billing Requests API - supports all of the latest GoCardless payment features

Billing Request Flows - provides a great experience for your customers when experiencing GoCardless payment features.

GoCardless payment features - recurring payments (Bank Debit), instant payments (Instant Bank Pay) and our latest anti-fraud open banking features (Verified Mandates and Protect+).

Note - GoCardless also has other products and features that aim to solve payment pains which you can explore on our website.

The Billing Request Flow API allows you to create the payment journey options and features you wish to enable:

Taking instant payments

This feature is also known as Instant Bank Pay, which enables you to collect payment on the spot and get instant confirmation. This is ideal for individual charges for goods or services, account top-ups, and seamless invoice payments. Available for UK (GBP) and Germany (EURO) payments for now with more schemes coming soon (see more detail).

Creating mandates for future recurring payments

This can be done in two ways:

Integrate Direct Debit mandates (default format)

Collect customers' bank details and authorisation for collection of future recurring payments by Direct Debit. Available in all supported schemes.

Integrate GoCardless Protect+ (anti-fraud open banking features)

GoCardless Protect+ uses payment intelligence and machine learning to risk score payers so that payers who attempt to create a mandate but exceed the risk score are sent to the Verified Mandates flow.

GoCardless Protect+ also reports on fraud levels and can be used to challenge fraudulent chargebacks in some schemes.

All GoCardless Protect+ functionality can be managed by your GoCardless dashboard account. See if this is available for me.

What are Verified mandates?

Verified Mandates is a feature that reduces the chance of fraudulent customers by adding additional verification checks when the customers authorise their bank accounts within the GoCardless payment flow. Verified mandates can be enabled independently of Protect+ if you do not wish to enable Protect+. See if this is available for me.

Combining both one-off and recurring payments

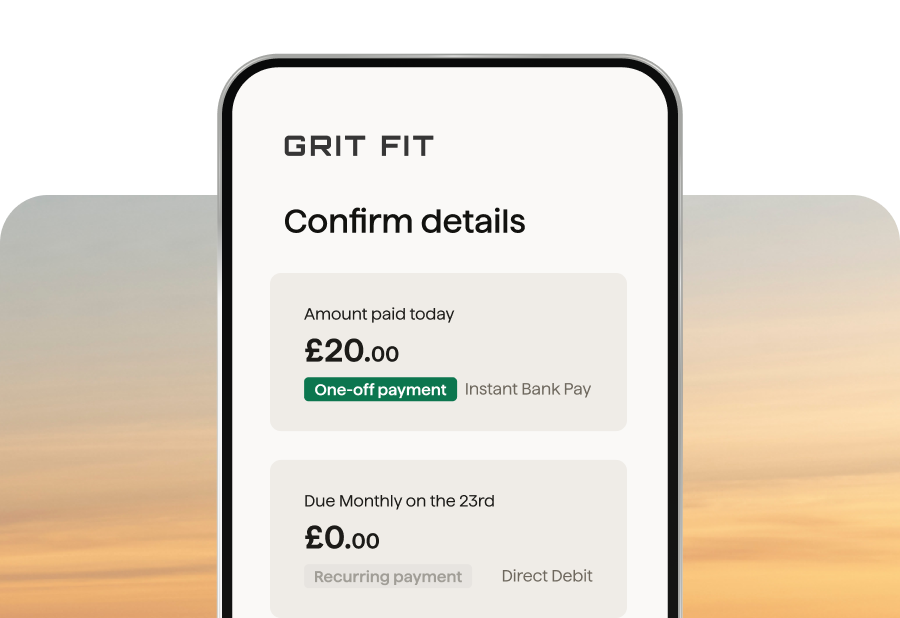

Take a first-time payment whilst setting up a mandate for subsequent payments. First-time payments can be created either via the latest Instant Bank Pay feature via Direct Debit, both use the Billing Request Flow API.

Why use the Billing Request API?

We’ve made significant changes when releasing the Billing Request API which creates a much simpler integration experience. Here’s what’s changed:

Old API (prior to 2021) | New Billing Request API (2021 - ) |

|---|---|

If you were building an integration using the old API, you would have been required to complete a series of potentially complex and unguided API calls. This resulted in a more complex way to combine multiple payment flows. | We have massively simplified the integration experience by: Presenting the building blocks to a much more guided and streamlined payment flow by using the latest open banking technology. Created an optimised payment flow for your customers to experience Given you access to any new open banking-related features released in the future. Note that Billing Request Flows can be hosted by GoCardless, or by using our drop-in solution. You will have access to the following features: Scheduled, recurring payments - Bank Debt Instant payments - Instant Bank Pay Our latest anti-fraud open banking features - Verified Mandates, Protect+ |

Start integrating Billing Request API

Instant one-off payments

Collect a one time payment faster than the typical Direct Debit (6+ days) timeline.

Creating Mandates

Collect customers' bank details for future payments. Verified Mandates feature performs extra checks to ensure customers are genuine.

First instant payment and mandate set up

Take a first-time instant payment (i.e joining fee) with a mandate set up for subsequent payments.

What’s next?

Take a one-off Instant bank payment