Guides

Bank Payments

Overview Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend money

Introduction to Outbound Payments Payment Account API request signing Send an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentOptimise and increase revenue

Prevent fraud with Protect+ Retain customers with fallbacks Reduced failed payments with Success+ Tutorials

Taking Direct Debit payments using Billing Requests and Custom Payment Pages Handling tax Handling Customer Notifications GoCardless Embed

Introduction Creating a creditor Adding a creditor bank account OptionalSetting a scheme identifer OptionalSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandateBilling Request (Instant Bank Pay feature)

Take a one-off Instant bank payment

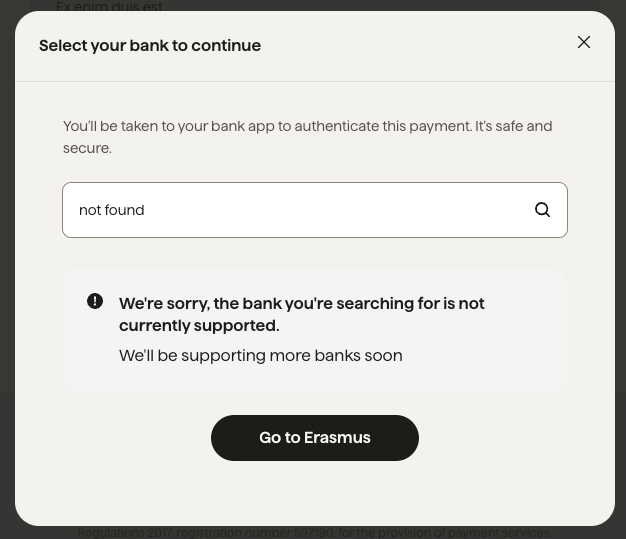

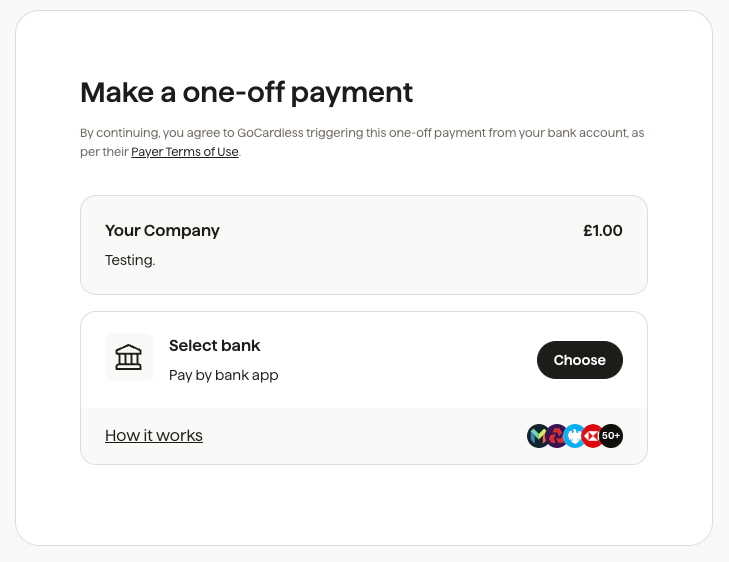

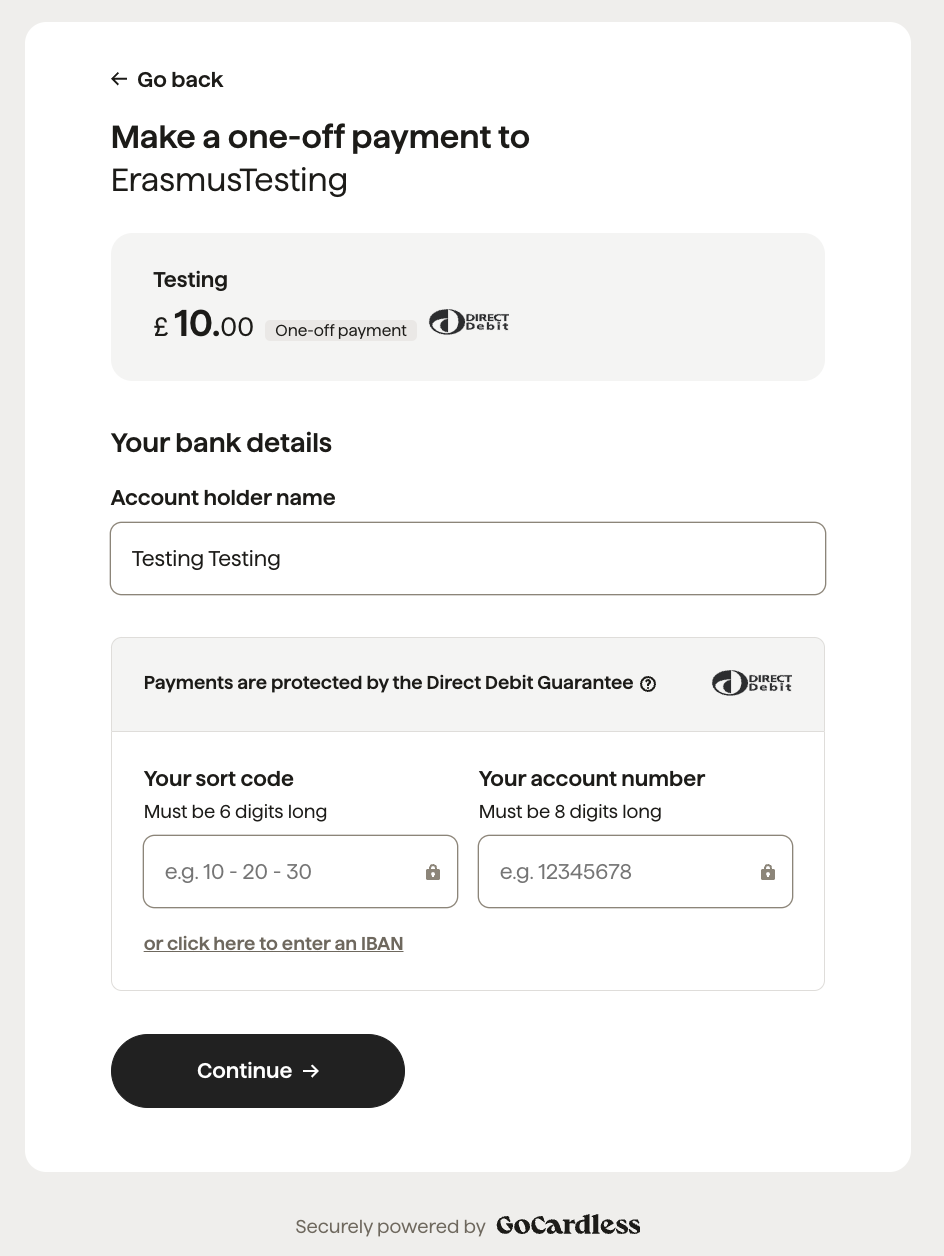

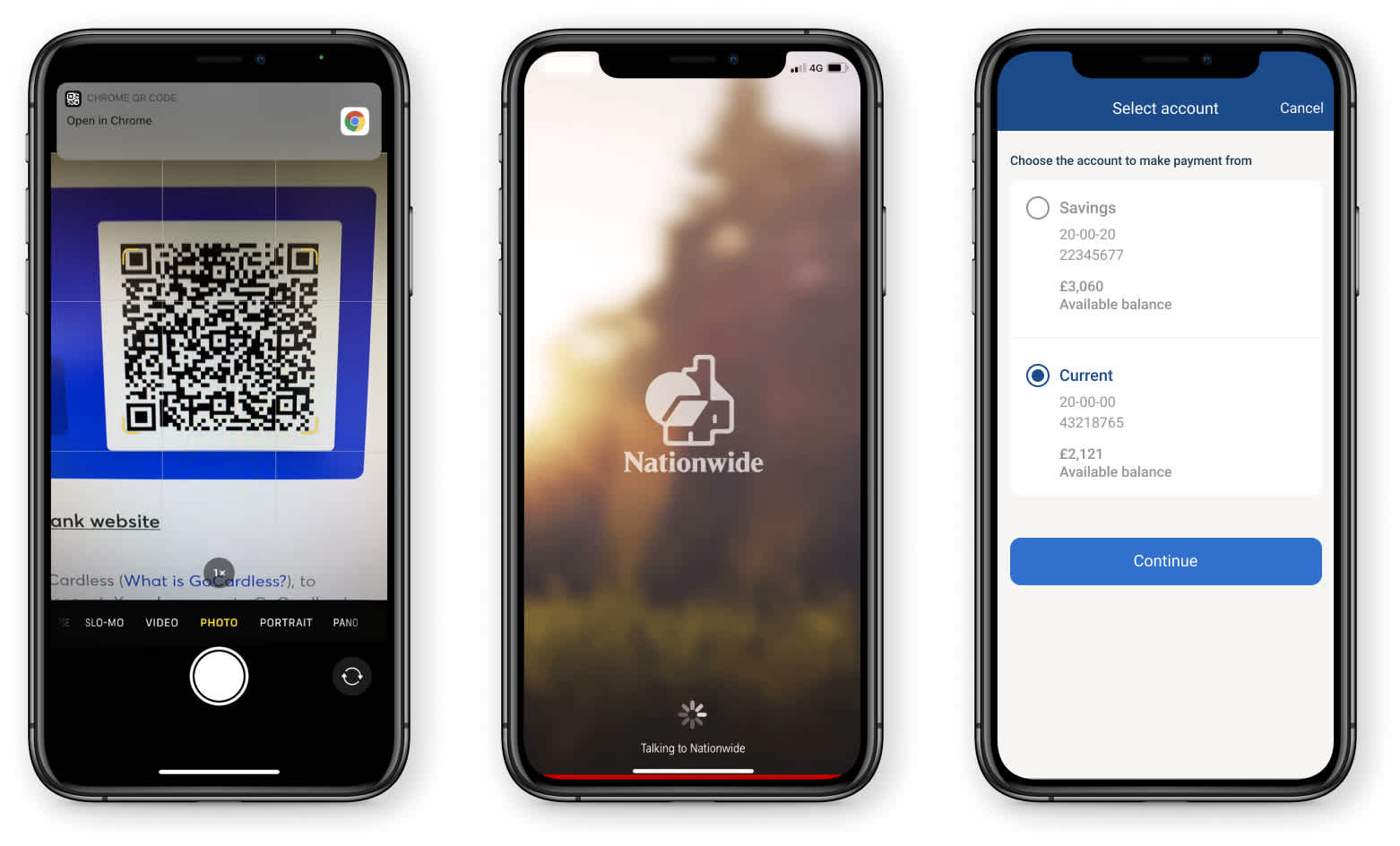

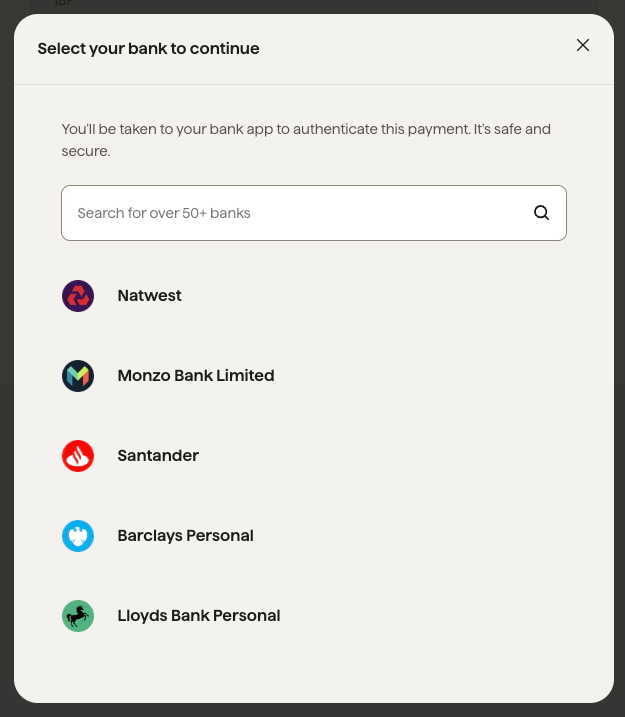

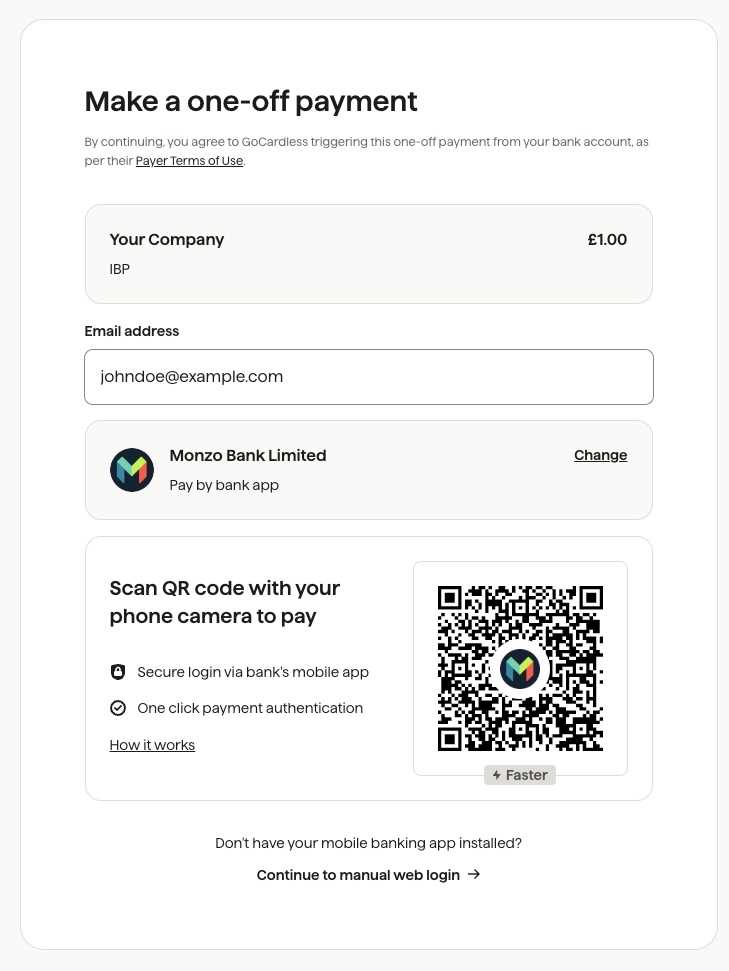

What the customer will see

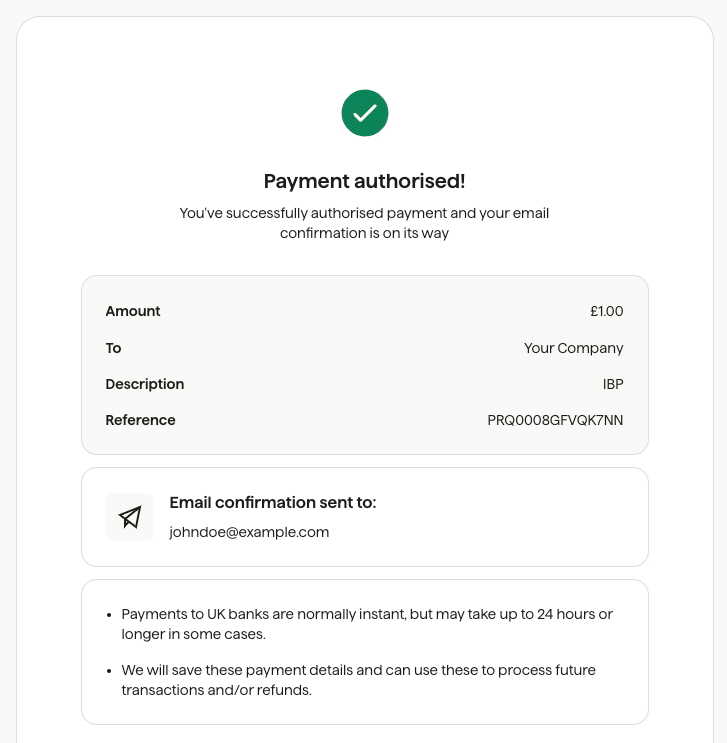

Done!

The payment has now been completed, and the Billing Request is fulfilled. Because this is an instant bank payment, the funds are confirmed within minutes of the request going through and leave the customer’s bank account immediately.

What’s next?

First instant payment with mandate Direct Debit set up