Guides

Bank Payments

Overview Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend money

Introduction to Outbound Payments Payment Account API request signing Send an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentOptimise and increase revenue

Prevent fraud with Protect+ Retain customers with fallbacks Reduced failed payments with Success+ Tutorials

Taking Direct Debit payments using Billing Requests and Custom Payment Pages Handling tax Handling Customer Notifications GoCardless Embed

Introduction Creating a creditor Adding a creditor bank account OptionalSetting a scheme identifer OptionalSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandateBilling Requests: Direct Debit Mandates

Collect Mandates

What is a Direct Debit Mandate?

Before you can collect any payments by Direct Debit, your customer must issue you with a mandate. This mandate is called a "Direct Debit Instruction", or "Direct Debit Mandate". Please note, that without a mandate, your bank cannot authorise the Direct Debit Instruction which allows your customers to collect future payments automatically. See more information about Direct Debit mandates within our resource guides."

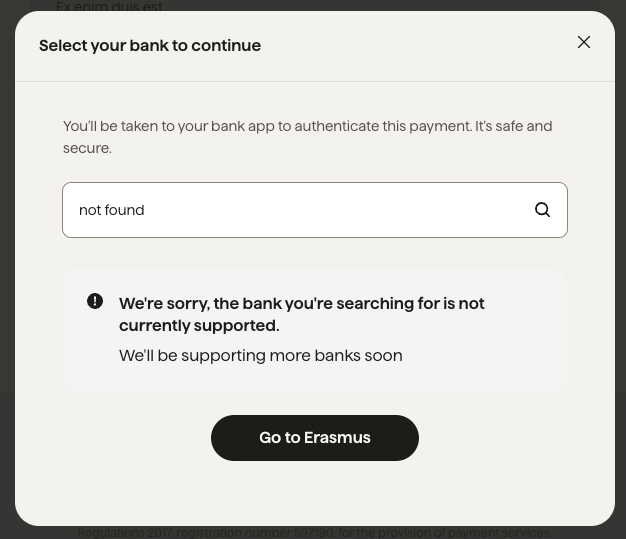

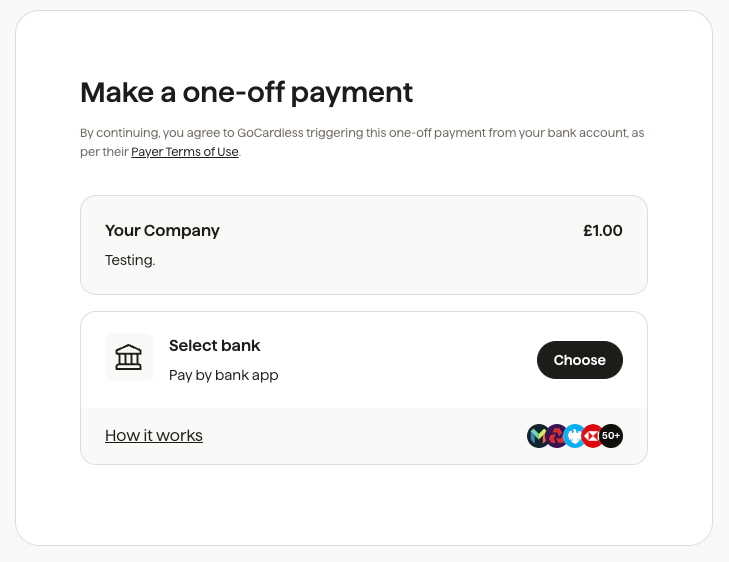

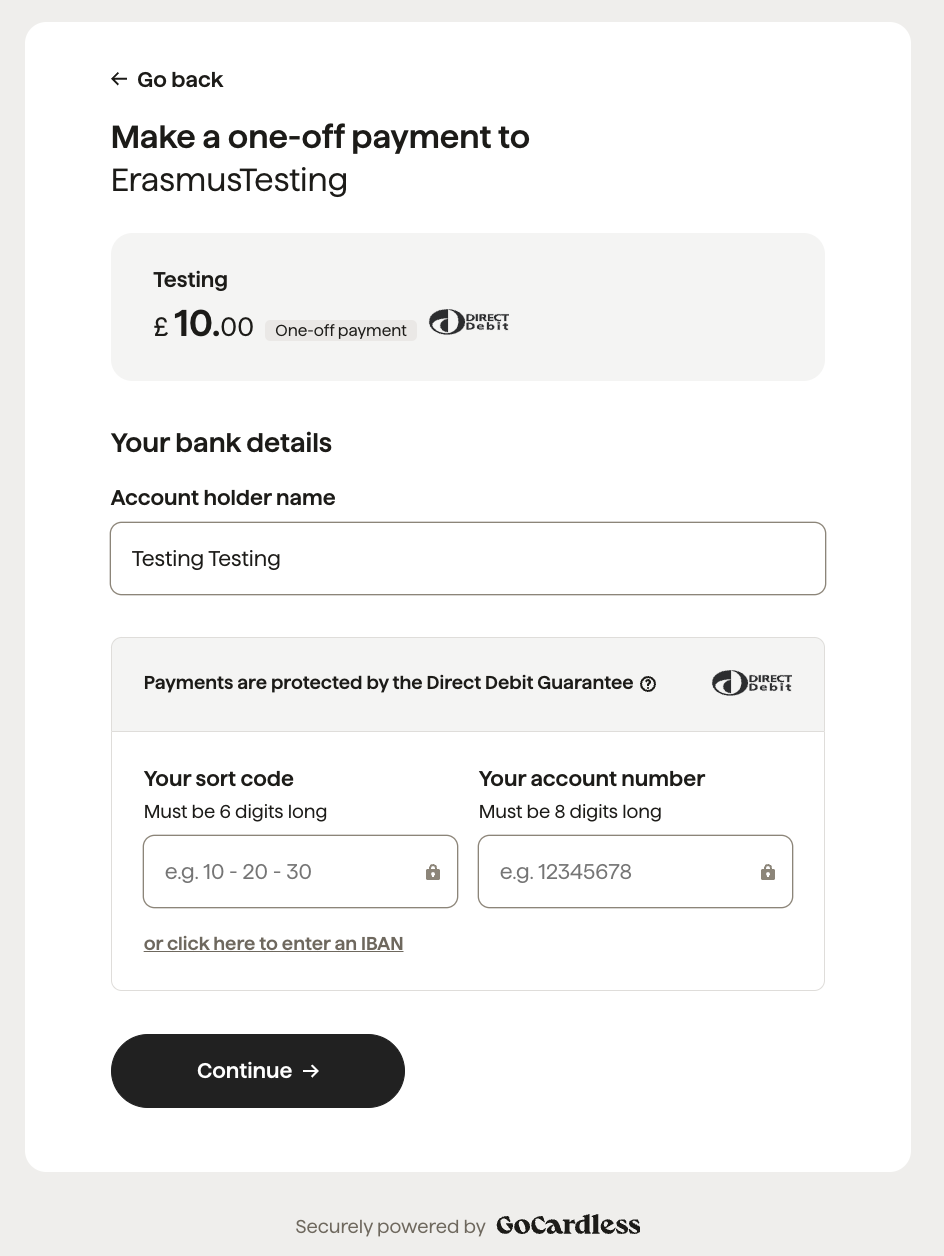

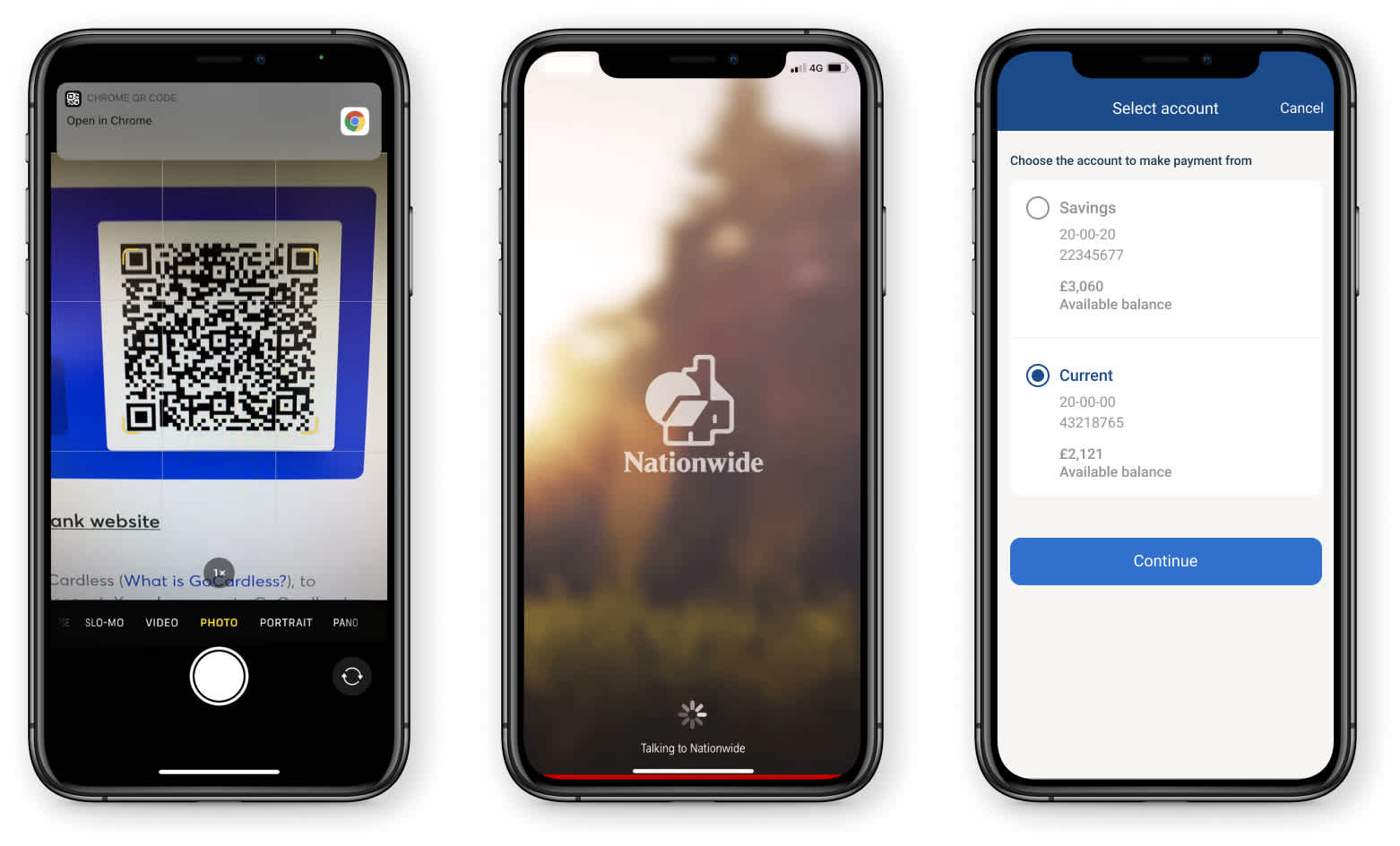

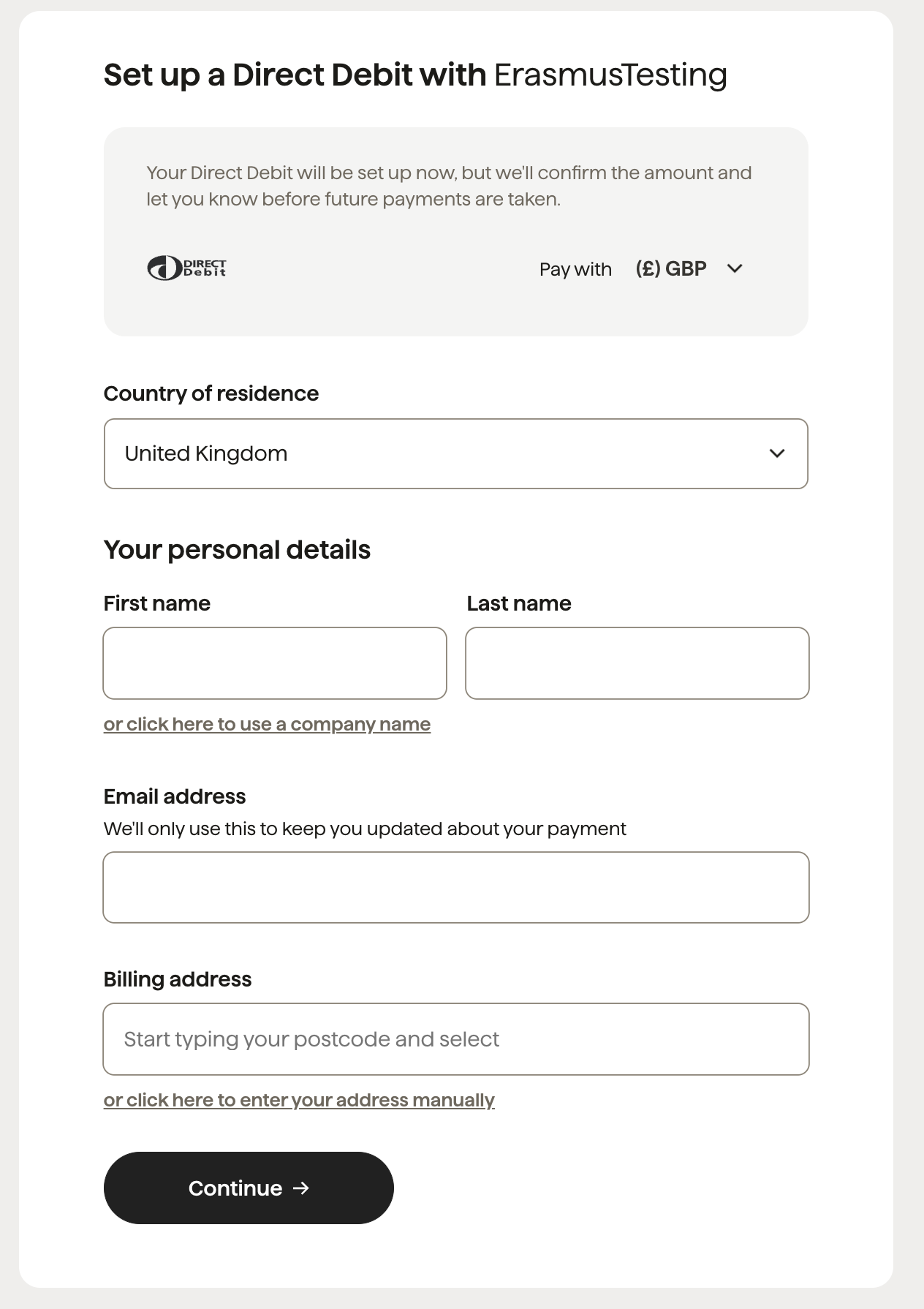

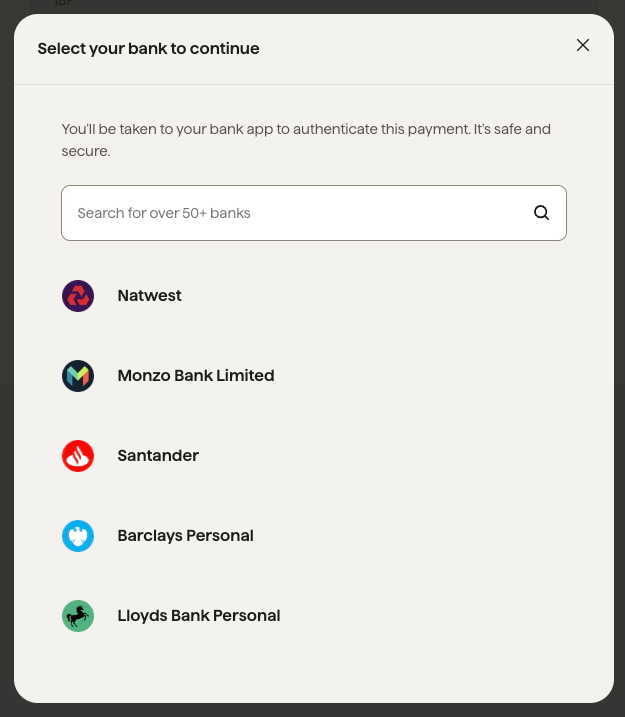

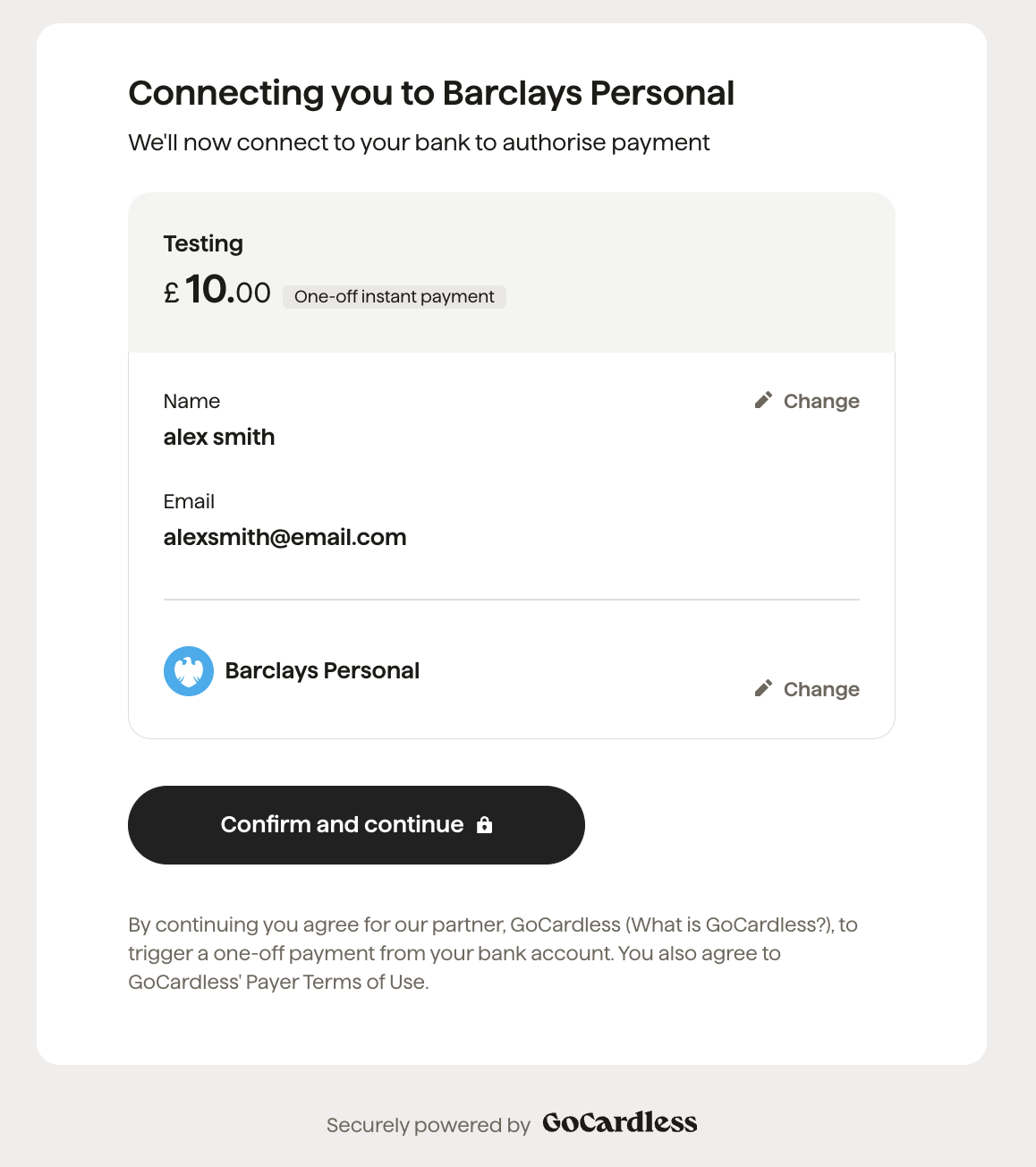

What the customer will see

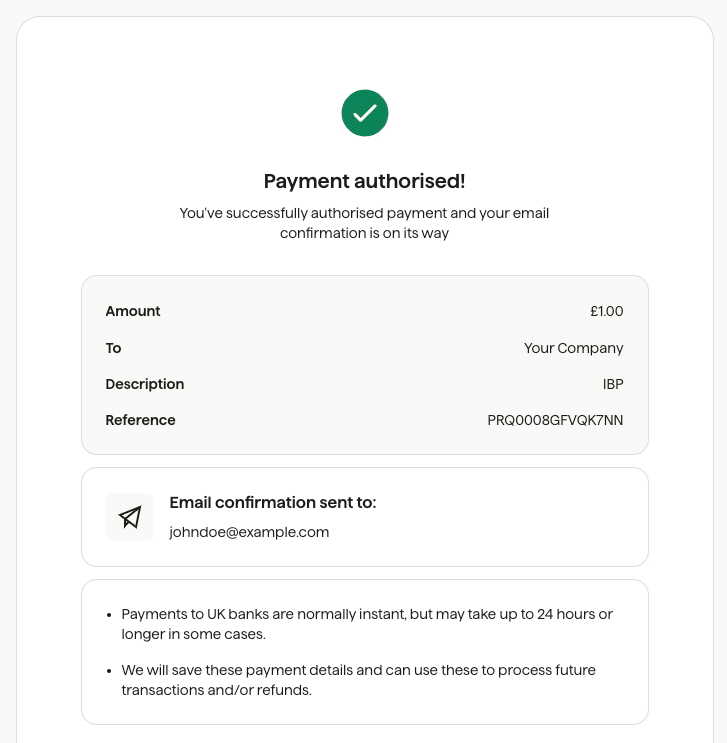

Done!

The mandate has now been created and is ready to create payments against. The Billing Request is fulfilled, and cannot be modified.

What’s next?

First instant payment with mandate Direct Debit set up