Guides

Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandateVariable Recurring Payments

Variable Recurring Payments (VRPs) are a powerful new capability for Open Banking in the UK. With VRPs, you are able to create a single consent with a customer that enables you to charge multiple real-time payments within agreed parameters. VRPs enable innovation in payment experiences and the creation of new types of financial services.

VRPs vs Direct Debit

There is a fundamental difference in these mechanisms, Variable Recurring Payments are ‘push’ payments, initiated by the payer (the customer) while Direct Debits are ‘pull’ payments, initiated by the payee (a business) to the payer.

The OBIE is yet to mandate VRP as a direct replacement for DirectDebit, but for many use cases, VRP will be a more flexible, faster, and more secure alternative to DD.

What are the key benefits of VRPs?

Secure Payers use banking app/online banking for providing consent so as to secure as that.

Fast Confirmation can be provided within seconds. While funds are also transferred within seconds, due to GC being in the flow of funds, we will pay out the next business day i.e. D+1

No Fraud/Chargeback Risk

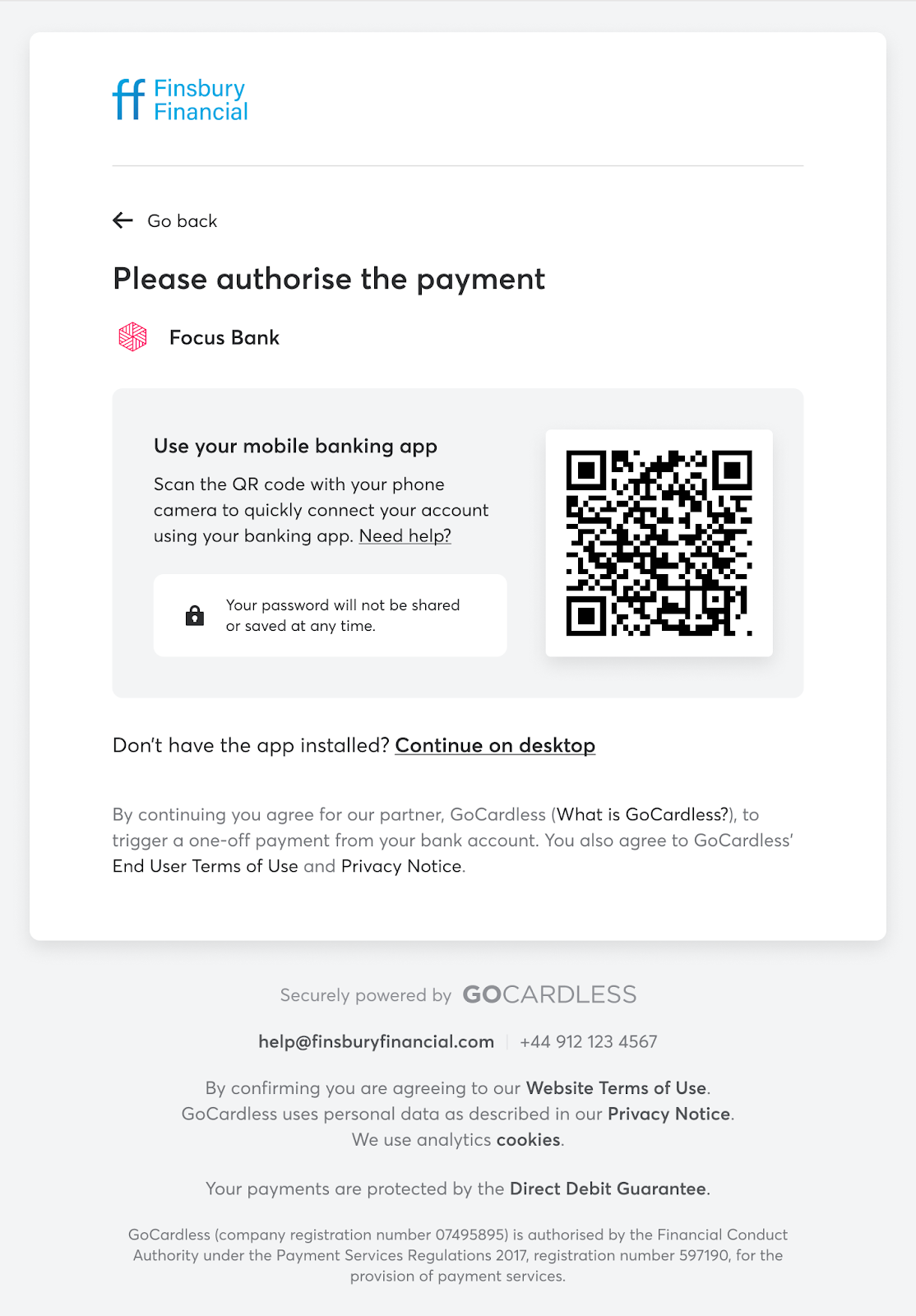

Slick user experience As payer uses a banking app (or online banking) to approve the transaction. It could be a very slick, friction-free payments experience. Payers can also review and cancel any mandates directly from their banking app, which gives them a lot of control on their recurring payments

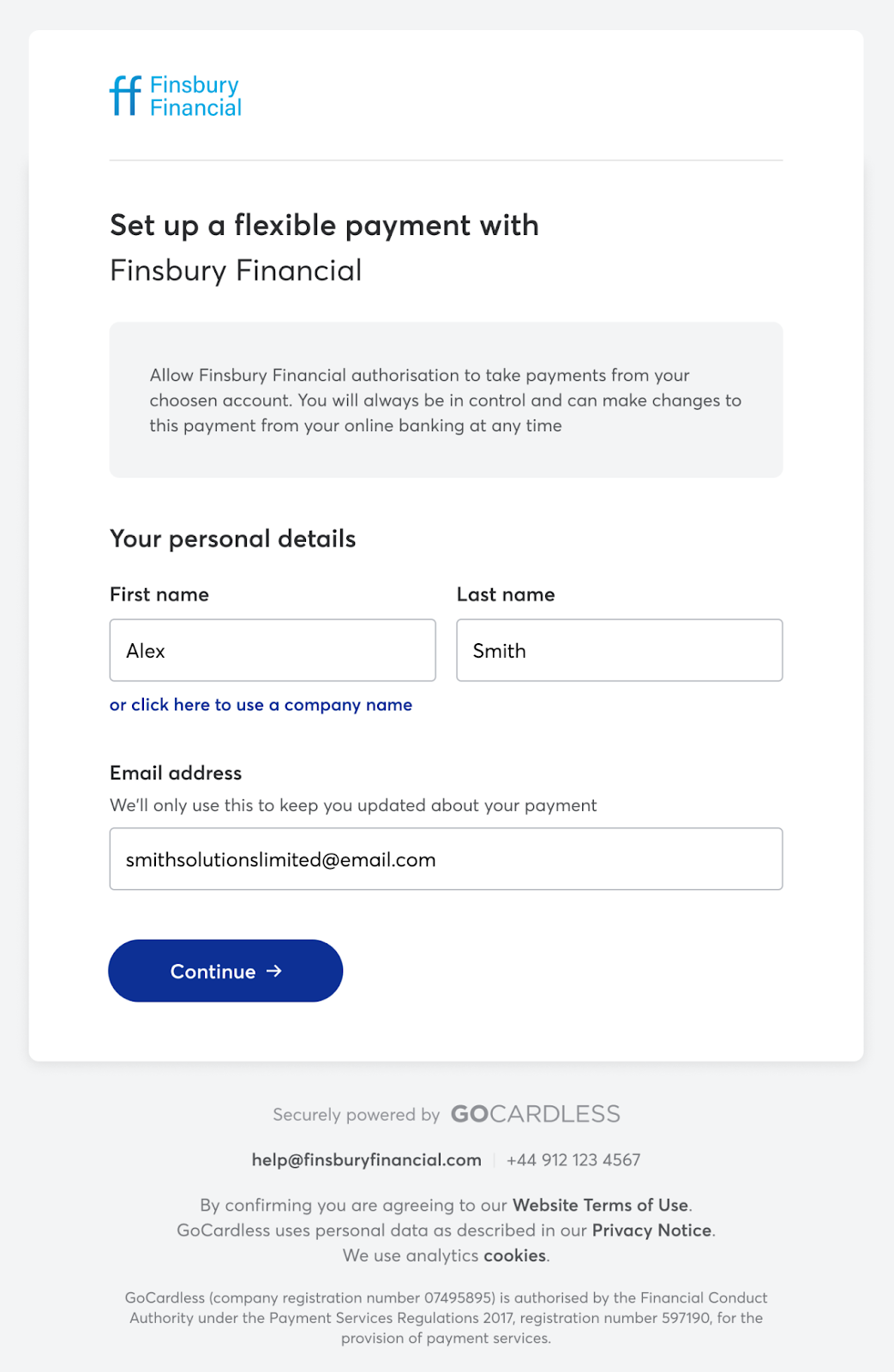

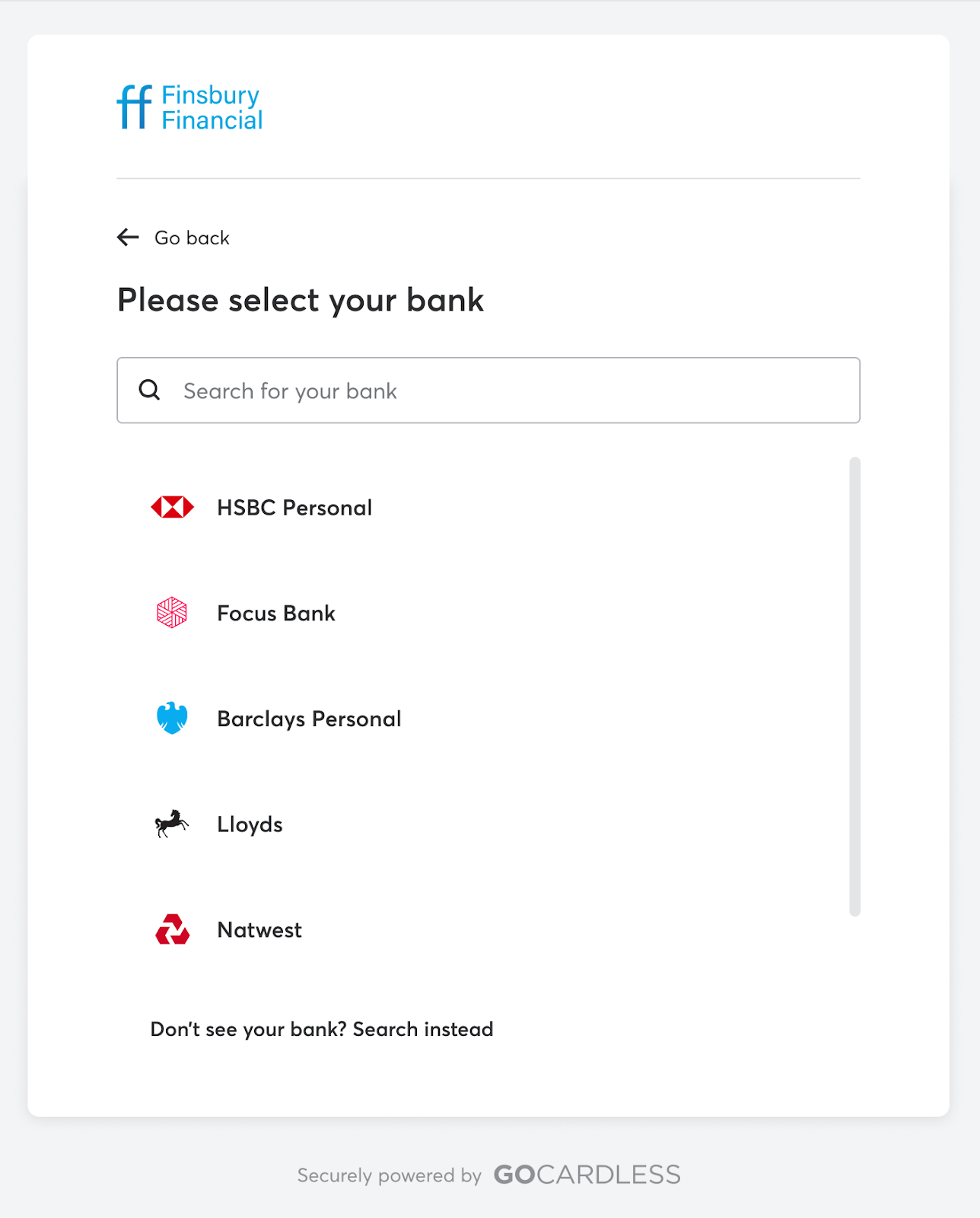

What the customer will see

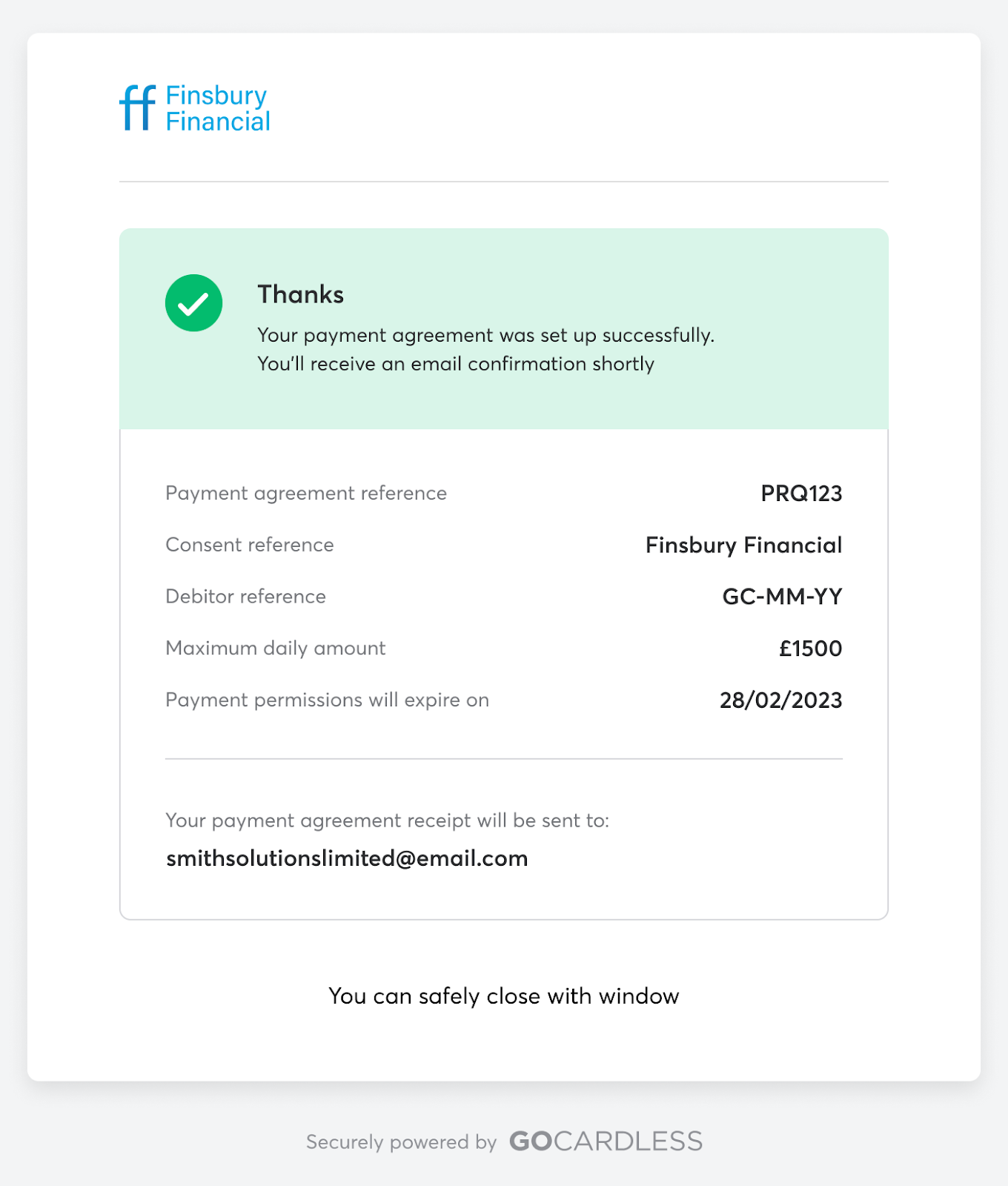

Done!

The VRP consent has now been created and is ready to create payments against. The Billing Request is fulfilled, and cannot be modified.

What’s next?

Responding to Billing Requests events