Guides

Setting up mandates

Direct Debit Mandates Verified Mandates PayTo Agreements and Payments Build a client to create mandates offline Supporting mandates set up outside of your product Importing Mandates Blocking mandatesRecurring payments

Taking Subscription payments Taking Instalment payments Variable Recurring PaymentsCombining one-off and recurring payments

Take a first Instant Payment with mandate set upSend an outbound payment

Adding a new recipient Initiate an outbound payment Approve an outbound payment Cancel an outbound paymentSetting up mandates / collecting payments

Billing Request with Actions: Setting up a Direct Debit mandate Collecting a Direct Debit payment Billing Request with Actions: Taking an Instant Bank Payment Billing Request with Actions Dual Flow: Taking an Instant Bank Payment and setting up a Direct Debit mandatePayment Account

Your Payment Account

As part of the onboarding process for this feature, we will create a Payment Account for your organisation to fund the payments you wish to send. You can find the details of this account on the "Account Funding" page (Account Balance -> Manage -> Account Funding).

Please note, that any available funds in this account will be automatically returned to your nominated (and verified) business bank account on the first Tuesday of January, April, July, and October to comply with regulatory requirements. We’ll send you a reminder in advance of these automatic returns, giving you time to create any payment instructions as needed.

How to fund your Payment Account

To comply with FinCrime regulations, any top-ups to your Payment Account must be made from your nominated (and verified) bank account, as established during the general onboarding process.

We offer two funding models for your outbound payments:

Direct Funding - in this model, you will use your Payment Account bank details to make direct bank transfers to fund the account. If you’re also collecting payments with GoCardless, outbound payments and collection payouts are kept separate: you manage the funding of your Payment Account manually, while payouts from collections are sent directly to your business account.

Funding from Collections - in this model, we will redirect your collection payouts to your Payment Account. This means the money you collect from your customers can be used to fund outbound payments. However, you are responsible for organising withdrawals to your nominated business bank account, which can be done using the endpoint we provide. You can also manually fund your Payment Account if needed.

By default, your organisation will use the Direct Funding model. If you prefer the Funding from Collections model, let us know, and we’ll configure it for you. You can also switch the funding model yourself anytime on the "Account Funding" page (Account Balance -> Manage -> Account Funding). The change will be applied instantly to your organisation.

How to check your balance

A balance check is essential for ensuring that your Payment Account has enough money before executing any outbound payments, helping to prevent "Insufficient Funds" errors.

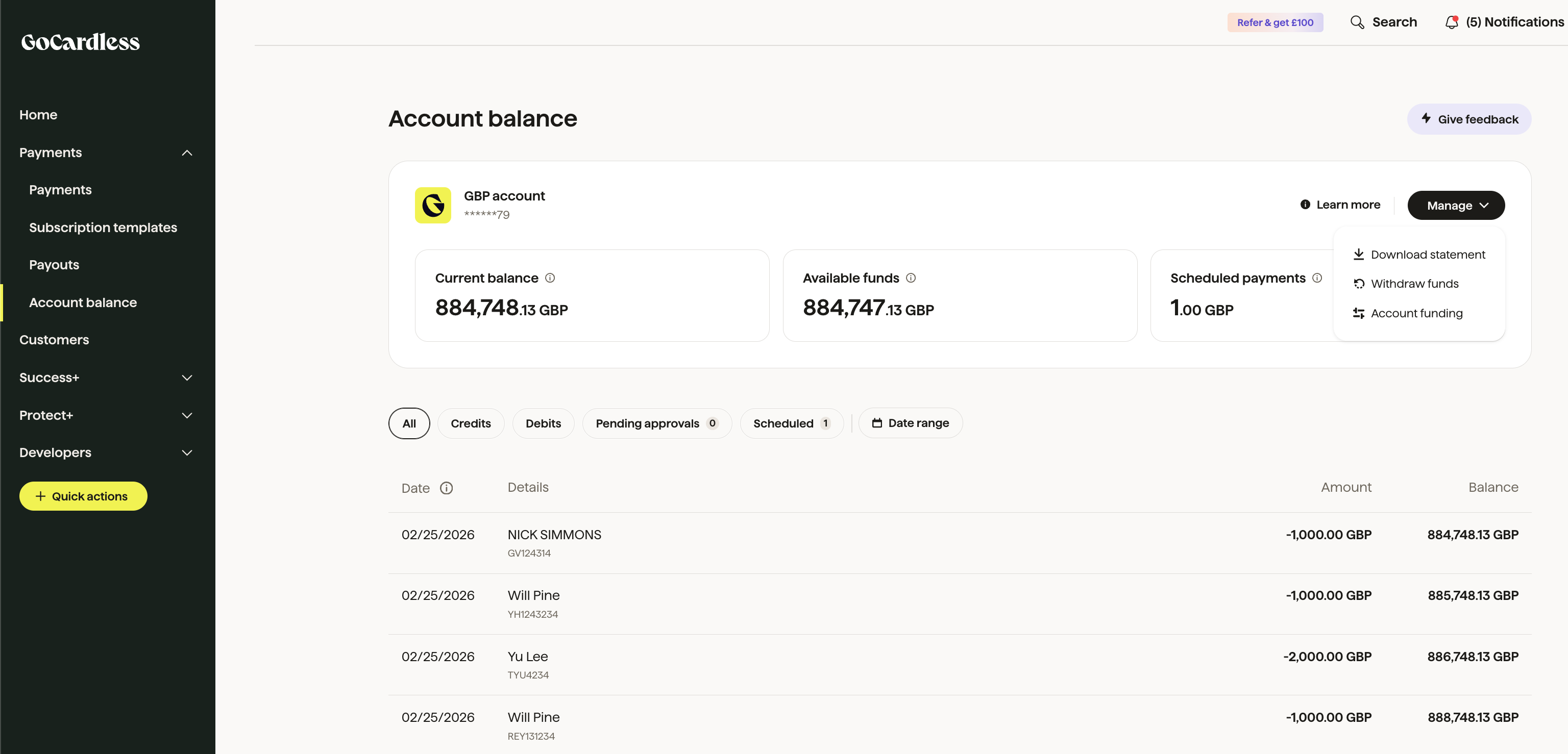

You can view your balance in the GoCardless dashboard by expanding "Payments" in the right-hand menu and selecting "Account Balance". It displays three key figures:

"Current Balance" - this value represents the total amount of money in your Payment Account, which can only be 0 or more. Please note that this balance reflects the amount before any scheduled payments are deducted.

"Available Funds" - the current balance minus any scheduled payments. This value can be negative if scheduled payments exceed the current account balance.

"Scheduled Payments" - the total value of payments that are scheduled to be sent, helping you forecast the amount needed to ensure all payments are successfully processed.

The page also offers a few additional features:

downloading your account statement,

viewing account activity,

viewing pending approvals and scheduled outbound payments that are not yet reflected in the balance,

withdrawing money from the Payment Account,

configuring funding of the Payment Account,

viewing Payment Account details.

Building your own Payment Account UI

We provide API endpoints to support building your own Payment Account UI.

Start by retrieving your payment accounts using List Payment Accounts. Once you have payment account IDs, you can use it to pull in related data.

To show account activity, use List Payment Account Transactions, which returns all transactions for a given payment account.

If you’d like to display the current balance, you can fetch it from Get a single payment account, where the balance is included in the response.

To surface information about outbound payments that are scheduled but not yet sent — such as their total amount and count — use Outbound Payment Statistics. This endpoint returns aggregated data for outbound payments across different states.